For any family with $100 million or more in assets, managing those assets can be a full-time job. Ultra-wealthy families typically have dozens of trusts and partnerships, and an array of investments that require oversight and performance reporting. They also need sophisticated cash flow and liquidity management, not to mention extensive tax, estate, and philanthropic planning.

The complexity of performing all these functions can be overwhelming, which is why an increasing number of ultra-high-net-worth families are creating family offices to manage their wealth. Worldwide, Ernst & Young estimates there are 10,000 single family offices, of which 5,000 are in the United States. Half of these family offices have been established in the last 15 years, fueled by the global rise in the number of ultra-wealthy as well as dissatisfaction with the limitations of the off-the-shelf financial products and services provided by the financial services industry.

Although establishing a family office gives a family greater control over their wealth, more privacy, and access to customized services, it also has many challenges. The foremost challenge being that unless a family has at least $1 billion in assets, establishing a full-service family office that handles all its affairs is probably cost-prohibitive. That’s because hiring just a few high-quality employees can easily run more than $1 million a year.

As a result, many wealthy families try to take on too much with limited staff and end up under-serving the family in essential areas. Or they spend most of their time managing multiple providers, while over-paying fees to advisors who are not a great fit, such as big banks and brokerages that serve the mass affluent.

So, what’s the alternative?

For wealthy families below the $1 billion threshold, a single-family office should run lean and outsource some functions to capable partners. But families need to be strategic about which services they do in-house, what they outsource, and how they choose their outside providers. This article will provide a framework for making those decisions.

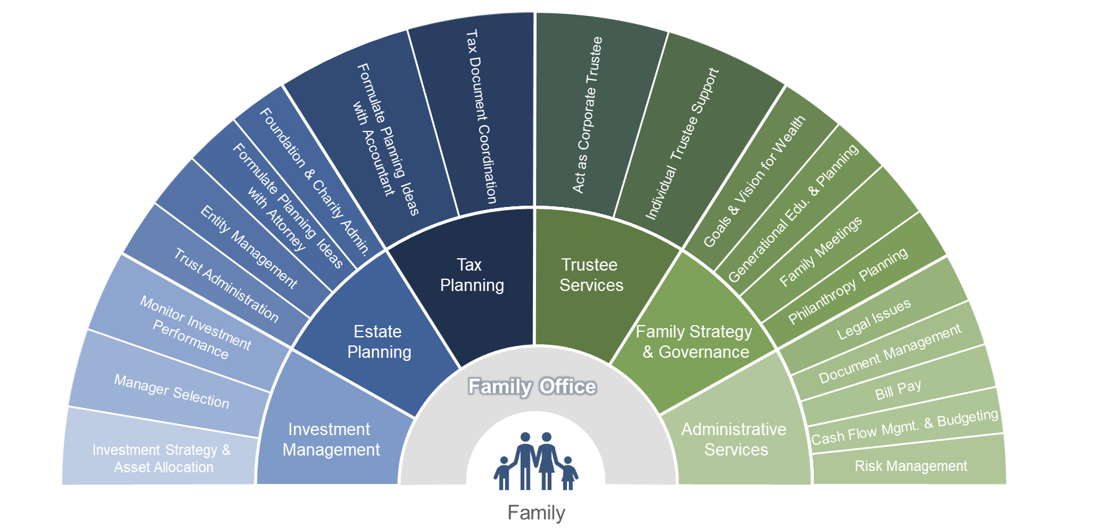

Services Commonly Provided by Family Offices

Types of Single-Family Offices

There’s a saying in the wealth management industry that “if you’ve seen one family office, you’ve seen one family office,” because the structure and function of these enterprises can vary widely. There’s no set template for how family offices provide the many services a wealthy family needs, from tax planning and investment strategy to trustee services and risk management.

However, single-family offices tend to fall into the following five categories, often with some overlap:

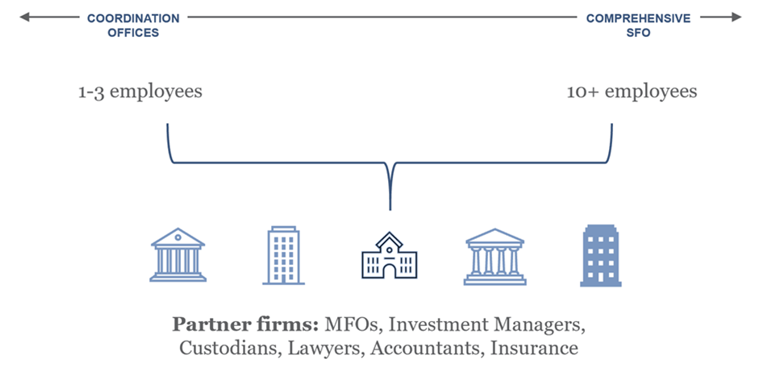

- Coordination office. These family offices are lightly staffed, with one to three employees, such as an administrative assistant or former finance or legal employee of the family business. This type of family office usually handles lower-level administrative matters, provides concierge services for the family, and coordinates outside advisors.

- Within the family business. Sometimes employees who work for the family-owned business spend part of their time providing family office services. These are often employees in the finance department, and they typically focus on administrative matters, trustee services, tax, and estate planning, as well as managing outside advisors. In this structure, an outside provider usually handles investment management.

- Investment management office. The employees in this type of family office are primarily investment professionals with experience and expertise in various areas of investments. Sometimes an investment management office will focus on one category of investment, such as investing in private businesses, and outsource everything else.

- Philanthropic focused. Wealthy families who give significant amounts to charity or have large foundations might have a family office that supports the family’s charitable giving and runs the family’s philanthropic entities. This kind of office sets and executes the family’s philanthropic strategy, undertakes charitable organization search and due diligence, and handles administrative matters related to charitable giving and monitoring.

- Comprehensive Family Offices. Some family offices are full-service, providing the entire suite of services: administrative, concierge, philanthropic, investment management, and whatever else the family needs. These fully-staffed family offices typically employ more than ten people and some have more than 25 employees. However, this kind of family office is usually out of reach for families with less than $1 billion in assets.

Defining Your Purpose

The first step to maximizing the effectiveness of your single-family office is to step back from what you’re doing now and think about what its purpose should be. What is your family office personnel good at? What world-class expertise do you have? What is best left to others either because it’s either not important to you or not your area of expertise?

The answers to these questions will help you determine what the focus of your family office should be. For example, one family I know built their wealth in the oil and gas industry. After they sold that business, they started a single-family office to manage their affairs. A big part of their investing continued to be in the energy sector. Many of the family office employees, who had worked in the family’s oil and gas business, sourced and evaluated investments in the energy sector. The single-family office outsourced the rest of its investment management activities to a partner firm. By focusing on where they had expertise and connections, this family office has a highly effective investment strategy with a reasonable cost structure.

When you’re deciding what to outsource, some functions that are often best left to others include:

- Activities that a larger firm could do more cheaply or efficiently. Many firms specialize in the types of services wealthy families need and have the resources to do them well. For example, it may make sense to outsource performance reporting to a partner firm because the software for customized reporting is expensive and running it can eat up a lot of family office personnel time. A partner firm that has already invested in performance reporting can provide these services at a low marginal cost.

- Things you cannot do world-class. It’s often challenging for a family office to provide is own tax planning and preparation and legal services at the level of sophistication and excellence they need. That’s why outsourcing these functions can make a lot of sense.

- Areas where having a provider that works with multiple wealthy families would be helpful (the n=1 problem). One challenge that single-family offices face is that their in-house experts only serve one family and may lack the perspective that working with many families provides. Partners who have broader experience may have solutions that better fit the particulars of the family. This is especially helpful in areas such as strategic philanthropy planning and educating younger generations on how to become effective stewards of the family wealth.

- Lower value work. Administrative services are often ripe for outsourcing because they are easy to delegate, and doing so frees the family office to focus on what’s important. Outsourcing tasks like bookkeeping, bill payment, financial statement preparation, private foundation administration, and performance reporting can save a family office time and resources better spent on something else.

Selecting the Best Outsource Partners

Just like wealthy families need to be intentional about the purpose of their family office, they also need to be thoughtful about the providers they choose to partner with. When a new family office is established, or control of the family office changes to a younger generation, sometimes it makes sense to keep legacy relationships. Other times it doesn’t. Having newly liquid wealth, or a new set of family members with different skills running the family office, may mean that new partners are needed. These partners need to be a good fit for the family office.

A family office needs to work with financial and investment professionals, accountants, lawyers, and other advisors that have experience working with families with substantial wealth and complexity. Providers that primarily work with the mass affluent are often not the best partners because the best financial solutions for families with great wealth often differ from those for the merely rich.

Here’s a simple example: using 529 plans to fund higher education expenses is a common financial planning strategy that is appropriate for most families. However, this is typically not a good idea for wealthy families because funding a 529 plan wastes the $15,000 annual exclusion amounts on expenses that are already exempt from gift tax. So, instead of funding 529 accounts, wealthy families should use their gift tax exemptions to fund irrevocable trusts and pay education expenses directly.

Because of exceptional circumstances like these, the following types of partners can be a better fit:

- Multi-Family Offices. A Multi-Family Office (MFO) is a firm that provides family office services to a select group of ultra-wealthy families. Most MFOs provide performance reporting, bookkeeping, bill payment, investment management, education of younger generations, strategic philanthropy, foundation administration, and tax and estate planning assistance. Hiring an MFO to fill in family office service gaps gives the family one point of contact for services often performed by multiple providers. And MFOs can typically perform these functions at a bundled price. Most MFOs only work with wealthy families with complex affairs and are used to providing customized services. As such, an MFO can be an effective partner to backstop the single-family office and provide customized outsourced services. Additionally, many MFOs are wholly independent and not motivated to sell high-cost products and services, which helps a single-family office control its costs.

- Investment Consulting Firms. These firms provide investment advice, outsourced CIO services, performance reporting, and investment due diligence. Although many investment consultants focus on tax-exempt entities such as pensions and endowments, some investment consulting firms have specialty divisions that serve wealthy families. It’s common for family offices to handle their private investments themselves and hire a consulting firm to assist them in public markets, or vice versa. Investment consulting firms can be a good way to deepen the family office’s investment resources often for the same cost as having an experienced investment professional in-house.

- Professional Firms. Although some family offices choose to have in-house tax or legal counsel, most outsource their tax and legal work to accounting and law firms. Besides providing tax and legal services, some accounting firms and law firms offer additional services to support family offices. For example, many handle administrative matters such as entity administration, foundation management, record keeping, and bookkeeping.

- Other Single-Family Offices. A good option for some family offices is to partner with other single-family offices. For example, a larger family office might be willing to provide performance reporting and administrative support for a smaller family office for a fee. A more common scenario is for family offices to join together to invest, particularly when one family has more expertise in an investing area. For example, I know of a large single-family office with significant expertise in investment real estate. When making these investments, they often allow other wealthy families to co-invest. This gives those other families the benefit of working alongside a deeply experienced and well-networked real estate investor family. The real estate family benefits as well because bringing on co-investment partners reduces their the amount of capital they need to invest in each deal providing them with greater diversification.

- Banks and Brokerage Firms. It’s common for family offices to partner with large financial firms such as banks and brokerages, which provide custody, loans, private banking, and access to their investment platforms. However, the focus of these firms is often on asset gathering and selling high-profit-margin products and services to clients. So, families need to be wary of the fees and the suitability of the products these banks and brokerage firms recommend. If you decide to partner with these firms, be sure to work with personnel in their specialized high-net-worth divisions who have experience serving ultra-affluent families.

Fit-for-Purpose

Great wealth often is accompanied by great complexity. With thoughtful planning, a family office can reap the benefits of outsourcing services that don’t fit its purpose while focusing on the family’s strengths. Making these decisions isn’t easy, but this framework will help wealthy families have the conversations that will help them get it right.