Artificial Intelligence (AI) is nothing short of amazing – it’s like a magic wand that turns data into insights faster than a cat video goes viral (joke credit goes to ChatGPT). The launch of generative AI platform ChatGPT brought AI to the masses, spotlighting its incredible capabilities that have permeated just about every field, from content creation to scientific studies. So, will AI soon take over the world of investing? Can we harness one of the most transformative technologies to bring us untold riches?!?

It turns out AI in investing is already here. But it didn’t just emerge out of the blue; rather, it has evolved over decades. Investment firms have been seeking the best technological approach for analyzing reams of data to predict favorable performance outcomes. The evolution began with computers mining data sets to find statistical relationships and patterns. Further enhancements in natural language processing and machine learning enabled investors to utilize data to identify better signals amid the noise. Firms have been formally branding the use of AI in their investment approaches for years. (Our company looked at an investment firm using AI back in 2018. It really sounded cool at the time, but we had no idea what to expect from the strategy . . . which is important to understand and be able to convey!)

If AI-based investing has been used by early adopters already, how has it done? As far as I know, there isn’t some new billionaire out there who owes their fortune purely to investment returns from AI processes. Although to be fair, if I were an investment manager that was killing it with my AI process, I probably wouldn’t advertise it.

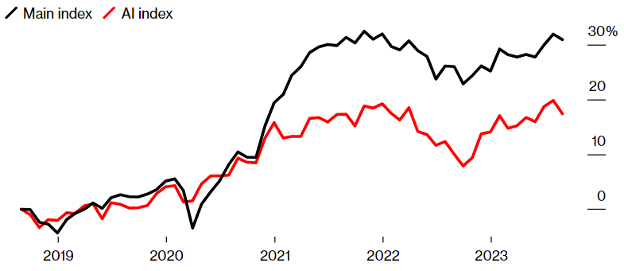

The following chart depicts the performance over the past five years of an index composed of 12 funds using AI. As you can see, the AI funds trailed the broader hedge fund index by about 14 percent. This is consistent with Plexus Investments’ findings that only 45% of AI funds outperform their respective benchmarks.

Eurekahedge Hedge Fund Indexes — Change Since August 2018

Well that’s…underwhelming.

Why isn’t AI-based investing winning? It’s hard to say. Historically, any data relationships that were discovered tended to be noticed by others and arbitraged away. If one investor knows a secret, they will do well. If several learn it, kiss that advantage goodbye.

Perhaps the multitude of unpredictable investor behaviors that are funneled through millions of participants with billions of dollars of capital is hard for any AI system, let alone any human, to truly understand and exploit. Markets are adaptive and reflect a complex recipe of human emotions, behaviors, and biases. While AI seeks to replicate our human intelligence, it will also have to capture our irrationality and unpredictability. Maybe AI will eventually discover some corner of the market it can outmaneuver, but my guess is that markets will always be one crazy, irrational step ahead.

(And no, ChatGPT didn’t write this article, as you can probably tell. I like to think there is charm in human imperfection.)