My charitably inclined clients know that giving appreciated publicly traded stock is one of the most efficient and effective ways to maximize the value of a charitable gift. But what if you are an insider subject to restrictions around your most appreciated holding? This is common for our clients who are C-suite executives or serve on boards of public companies. There’s good news for these clients: there’s an opportunity to gift shares to charity despite the restrictions.

Enter: 10b5-1 Plans

First, a bit of background. Restricted shareholders can only trade during what’s known as “open trading windows,” which are generally shortly after quarterly earnings calls. Even then, restricted shareholders are only allowed to trade if they do not have material non-public information, which can be tricky for executives and active board members.

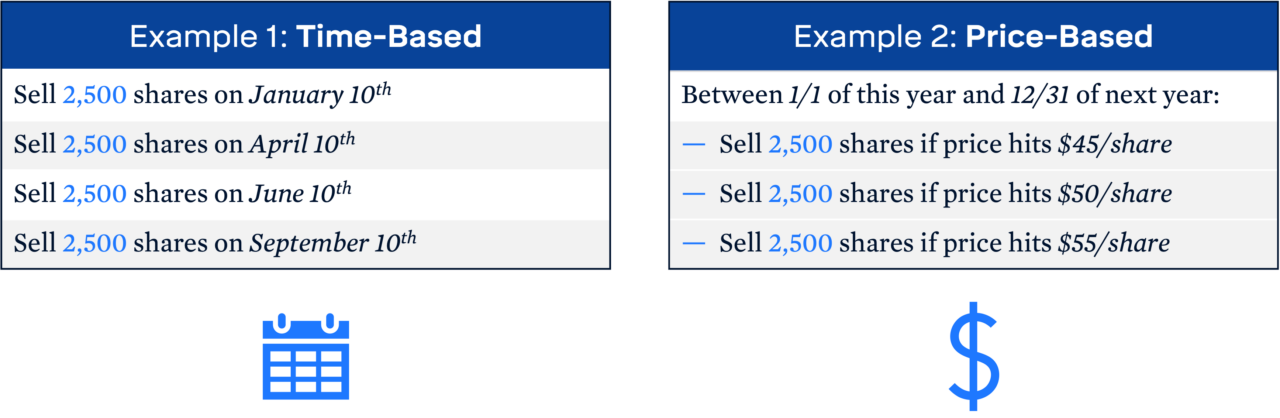

To address this issue, the SEC allows a “10b5-1 Plan.” This allows restricted shareholders to put in place a selling plan for sales at a future date, and trades made under the plan don’t violate insider trading rules even if the shareholder possesses material non-public information. The shareholder can set the parameters to suit their comfort – only sell this many shares, only if above this price floor, only long-term tax lots (to avoid short-term gains), only at these times of the year, etc. Shareholders can also set several different price floors, or select a combination of parameters. The key is to set it and forget it.

Examples of 10b5-1 Plans

For charitably inclined insiders, 10b5-1 plans are a particularly effective tool to maximize the value they get from their stock. Instead of selling, they can use the 10b5-1 to gift shares directly to charity (gifting shares are subject to the same insider trading rules as selling shares). Let’s take an example to see a 10b5-1 plan in action and how sizable a difference in value can be for a charitably inclined restricted shareholder.

Case Study: Mr. Green

Mr. Green is the CEO of XYZ Company, a public company in St. Louis. Mr. Green has plans to give $1 million to charity, and he would like to reduce his concentrated exposure to XYZ. How can Mr. Green use a 10b5-1 plan to maximize what he’s trying to accomplish?

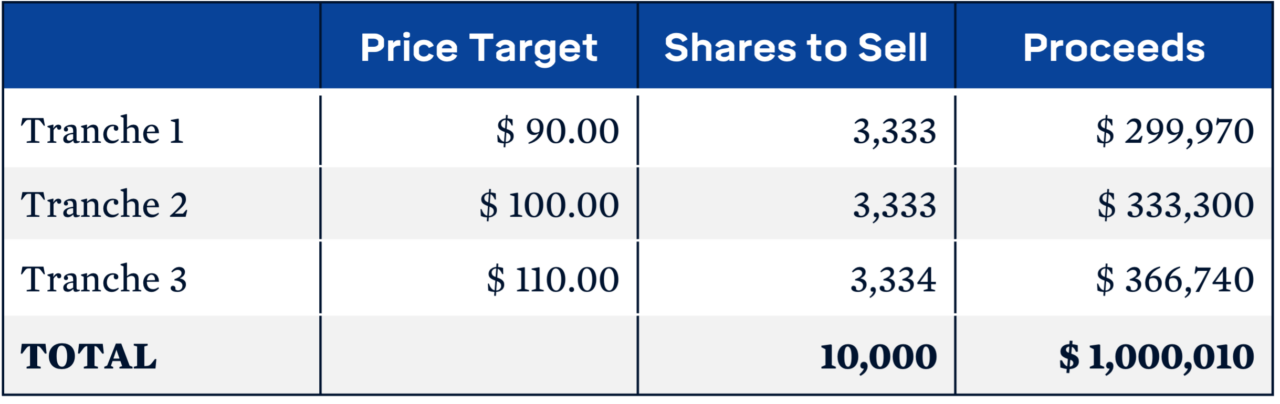

During an open trading window last year, when XYZ stock was trading at about $85/share, Mr. Green set up a 10b5-1 plan to gift to his Donor-Advised Fund 10,000 shares of highly-appreciated XYZ stock (cost basis of $1 per share) in three tranches at three different price targets. The first tranche would execute if the price hit $90/share, the second would go at $100/share, and the third at $110/share. If all three price targets are met, this would add up to proceeds of about $1 million.

Mr. Green’s 10b5-1 Plan

April of this year through December of next year

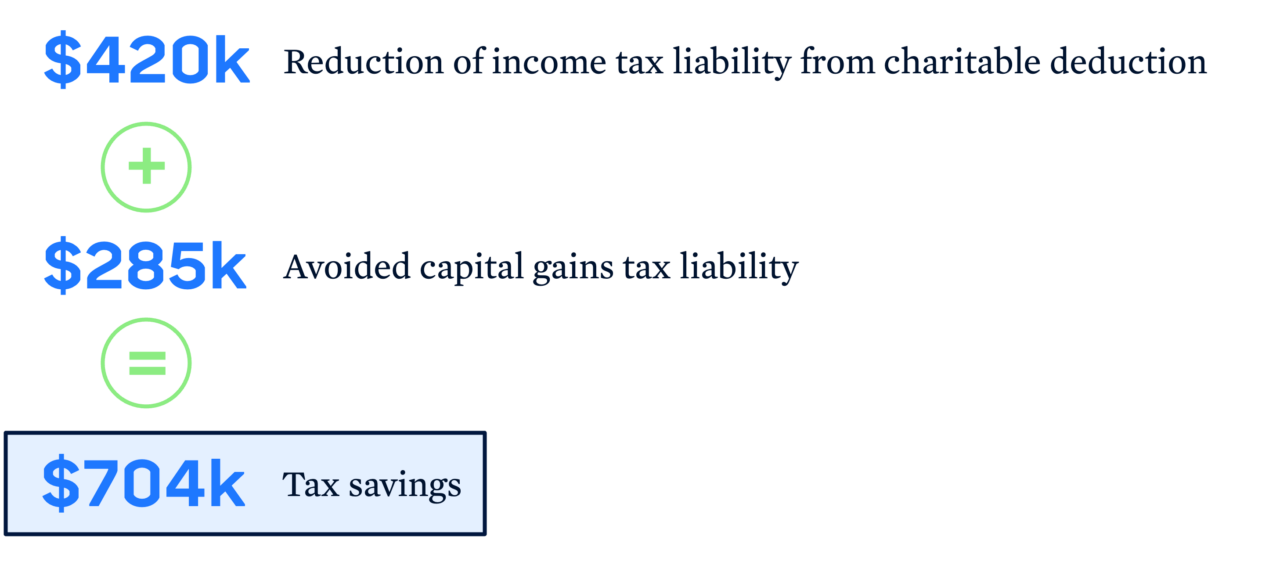

Mr. Green’s 10b5-1 plan was set to begin two months after he submitted it and stay in place through the end of the following calendar year. Let’s say that the stock price hits all three targets this year, so there are now $1 million of proceeds in his charitable account for him to divvy out to his beloved charitable organizations at levels and timing of his choice. Additionally, because the shares went to charity, Mr. Green avoided realizing the $990,000 underlying capital gains associated with these shares, and he will claim a $1 million charitable deduction on his income tax return. At Mr. Green’s high income tax brackets1, his $1 million donation saves him $704,000 in taxes:

Mr. Green’s Tax Savings

Thus, this is a compelling way to give to charity for charitably inclined restricted shareholders who do not rely on their shares for their lifestyle. It’s not, however, without its complexities and pitfalls.

Possible Pitfalls

The primary issue with setting up a 10b5-1 plan is that the shareholder has to decide on pricing, timing, and quantity without knowing what will happen. This is by design – the whole point of these rules is to allow an insider to legally get liquidity when they otherwise would not be able to due to their insider information. Unfortunately, this can lead to some “close, but no cigar” disappointments. I’ve seen a plan where the target was $100 per share, and the stock price reached $99.98 before plummeting 50%+ and staying low for the next five years. I’ve also seen clients put 10b5-1 plans with such high prices that they are never triggered. And I’ve seen a client set up a plan with timing but no price floors, resulting in a disappointing conversion of stock to cash during a short period of lower-than-normal stock prices.

Despite the pitfalls and complexities2, we find that 10b5-1 plans are an extraordinary tool for our generous restricted clients to maximize the value of their concentrated stock positions.

1 For illustration, we’re assuming the following flat tax rates: 37% federal income tax, 20% federal capital gains, 3.8% NIIT, and 4.95% Missouri. We also assume Mr. Green has more than enough adjusted gross income to realize the full benefit of this charitable deduction in the year the donation is made.

2 If you’re interested in the other pitfalls and complexities I’ve seen with 10b5-1 plans, such as how market analysts view them, I’d be delighted to discuss. Give me a call or shoot me a line.