Stocks had a banner year in 2023, with the S&P 500 index up 26%. And by stocks, I really mean the “Magnificent 7” (Microsoft, Amazon, Apple, Google, Tesla, NVIDIA, and Meta), which accounted for a whopping 62% of that gain. Excluding this powerhouse group, the index returned a measly 10% <golf clap>. One could view this outsized influence as an endorsement for stock picking (if you picked those stocks, that is). Should investors try to pick the “Next 7” stocks that will potentially carry the market?

For the better part of decades, the conventional financial wisdom has been to diversify and avoid taking concentrated risks with single stocks, as evidenced by the proliferation of active managers and ETFs bundling baskets of stocks to give investors broad exposure to various companies and industries. You’re not going to see a new BlackRock equity strategy pitched to investors: “We only own Amazon. That’s it.” (I mean, why would you pay for that anyway?). But is diversifying away from, say, 1-2 stocks costing investors the opportunity for significant performance gains? Why not go “all-in” on one or even a handful of stocks?

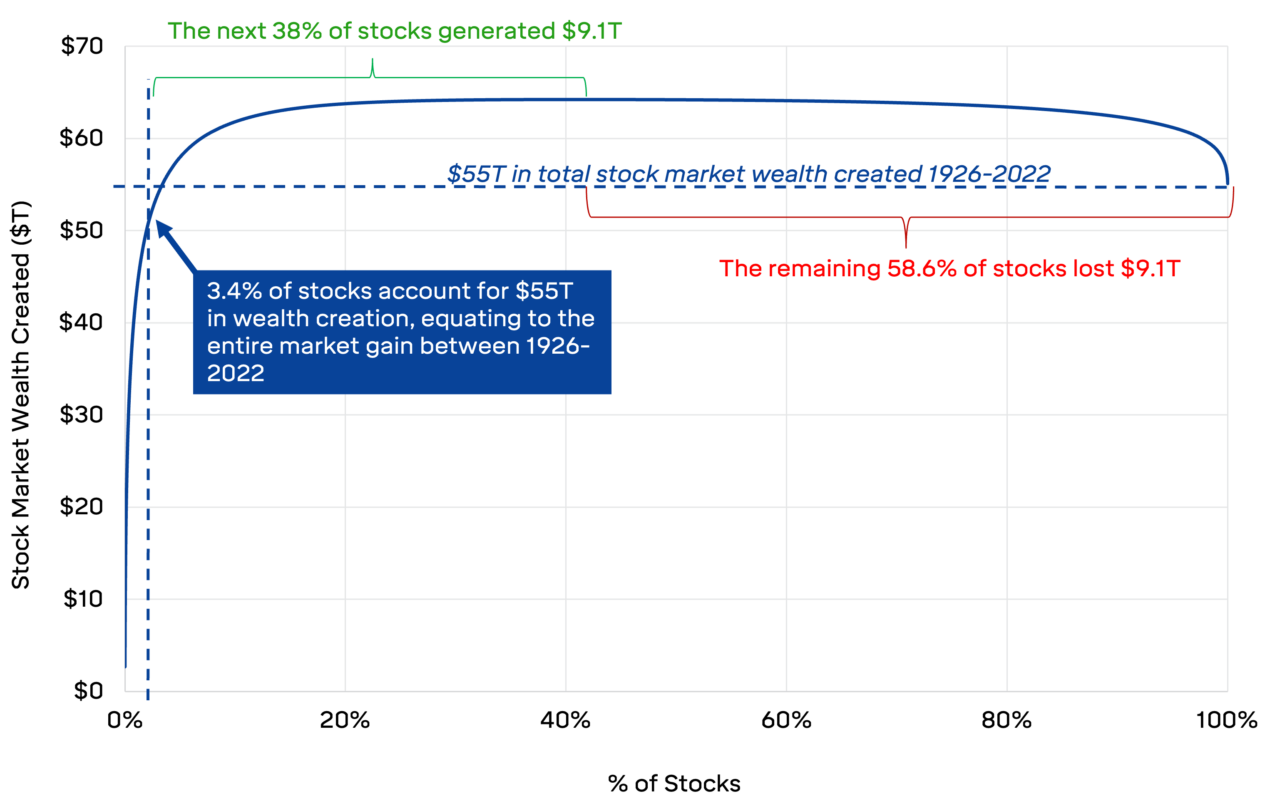

To best answer this question, it helps to look back and analyze the distribution of stock returns for each public company. It quickly becomes apparent that individual stock returns aren’t created equal. In fact, it’s not even close to resembling any sort of bell-curve distribution. Rather, stock returns follow a power law distribution meaning that a small number of companies have created the vast majority of the wealth in the stock market.

The below chart shows that a mere 3.4% of stocks have generated 100% of the $55T (with a T!) in aggregate wealth creation in the U.S during the period 1926-2022. The remaining 96.6% of stocks have all had varying successes but cumulatively have created zero net value for investors.

Distribution of Stock Market Returns 1926–2022

Buying individual stocks does pay off huge if you happened to pick one of those 3.4% of companies, which is slightly better than hitting a single number bet on roulette (2.6% odds).

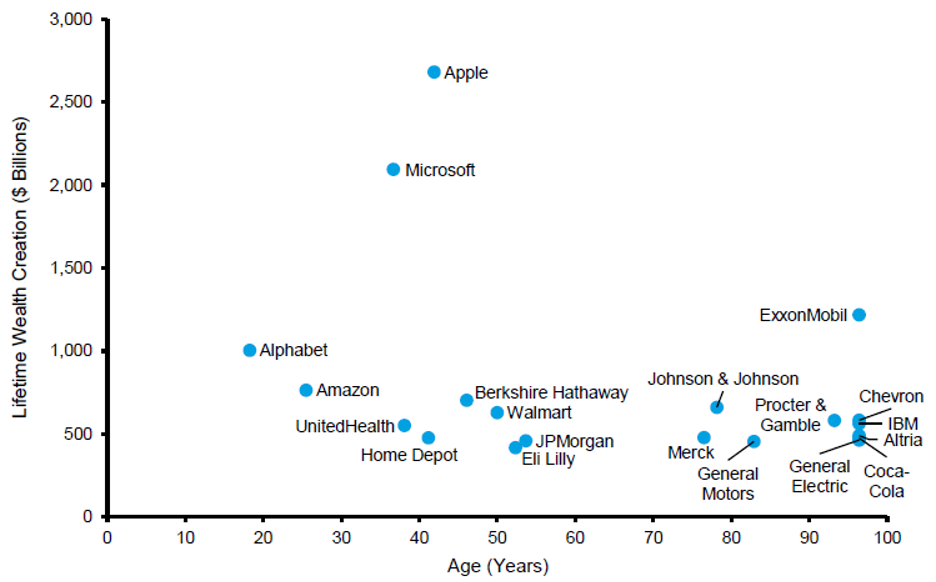

For those wanting a reveal of these tremendous compounders, the following chart from Morgan Stanley shows the total wealth created by the top 20 stocks and their age (measured in years as a public company).

Age and Total Wealth Creation of the 20 Top Wealth Creators, 1926-2022

Coca-Cola has been a tremendous wealth creator, adding around $500B of wealth for shareholders, but that has occurred over nearly 100 years. I’m a little impatient and thus more a fan of Alphabet (Google), which has created $1T of collective wealth for shareholders in the span of one’s childhood (18 years).

Is there a win-win here for investors? Fortunately, yes. To seek the benefits of a select group of compounders while remaining diversified and avoiding material risk of loss, buy a market index and remain patient. The largest wealth creators grow into the largest positions in most market-following index products. Apple has been part of the S&P 500 since 1982 and has occupied a top position, and outsized influence, for over a decade. If you’ve owned an S&P 500 mutual fund or ETF, you’ve captured its performance. And that type of investing gives you 100% odds.