The stock market is on a tear, driven by big tech and AI optimism, receding inflation worries, and a surprisingly resilient economy in the face of higher interest rates. The S&P 500 Index has notched multiple all-time highs this year and recently crossed the milestone level of 5,000. While all-time highs in the market tend to be celebrated, investors who are looking to put more money to work may question whether now is a good time. Should investors embrace these new highs or be cautious about what’s to come?

Hesitation to invest in the market at an all-time high seems rational, as investors might think they are overpaying when the stock market is at the highest it’s ever been. Plus, an index hitting 5,000 provides an extra dose of wariness because, in March 2000, the tech-heavy NASDAQ index climbed to an all-time high level around 5,000, coinciding with the dot-com bubble’s peak, and then subsequently fell nearly 80% over the next two-and-a-half years. It took 15 years for the NASDAQ to regain the 5,000 level and set new all-time highs.

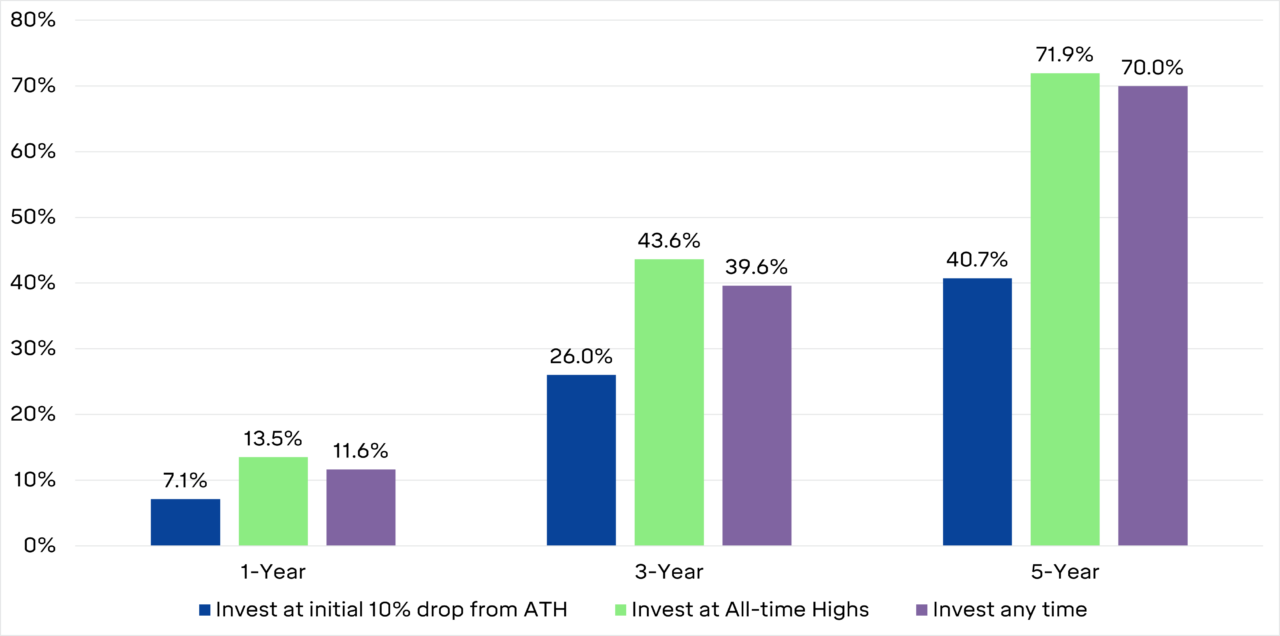

But the dot-com bubble’s collapse is just one data point. Looking at the data more broadly, we find that investing at all-time highs works out well. The chart below shows three investment timing scenarios: (1) waiting for a 10% pullback from all-time highs to invest (being cautious), (2) investing at the all-time highs (embracing it), or (3) investing on any given day (ignoring all-time highs).

Average Cumulative Returns of S&P 500 Index

1990-today

Counterintuitively, viewing an all-time high as a signal for caution and waiting for a 10% pullback was the worst strategy, delivering an average 1-year return of 7.1%, nearly 6.5% less than the 13.5% you’d earn investing at all-time highs. The results are similar if we look at the cumulative returns for the 3- and 5-year periods. Investing at all-time highs has led to higher average returns than waiting for a pull-back or randomly picking any time.

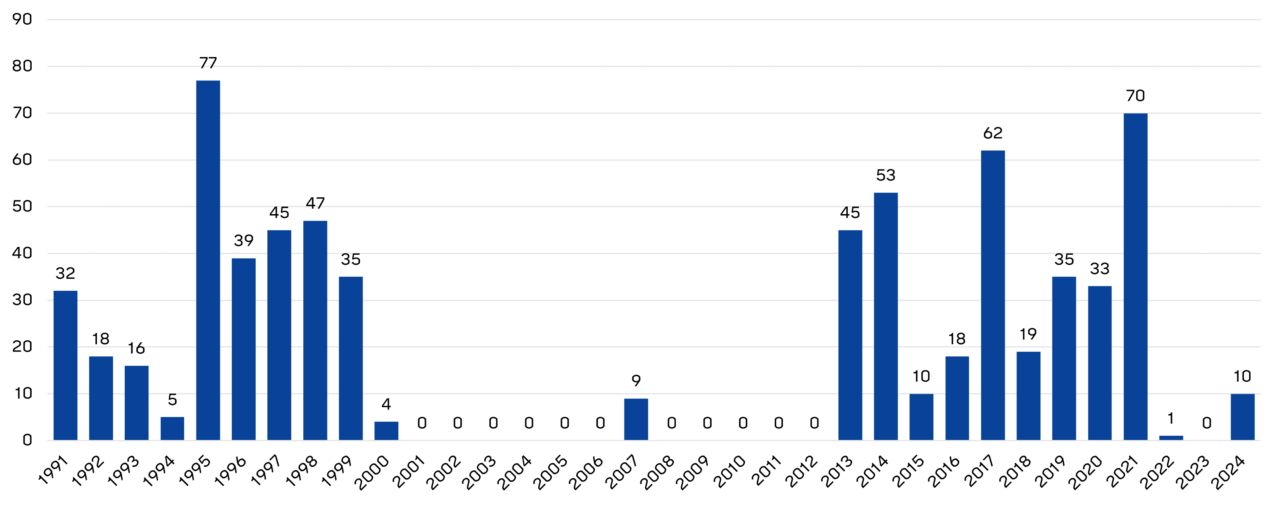

Why is this? The chart below shows the yearly occurrence of all-time highs in the S&P 500 Index from 1991. All-time highs in the S&P 500 Index have tended to cluster around periods of sustained economic growth and bull markets. Waiting for stocks to go on sale, so to speak, could leave investors sitting out of the market for a considerable time.

S&P 500 Number of All-Time Highs

Investors who avoided making investments because the market was at all-time highs would have missed out on meaningful returns. As always, the best bet is to maintain a disciplined strategy regardless of whether the market is receding to new lows or climbing to new heights.