Inflation has been running uncomfortably high since we emerged from the COVID-19 shutdown, yet TIPS, a popular inflation hedge investment, hasn’t provided the inflation protection investors expected. Why might that be?

First, let’s hit the basics of how Treasury Inflation-Protected Securities (or “TIPS”) work. They are like standard Treasury bonds, except that they are indexed to inflation. When inflation (measured by the Consumer Price Index (or “CPI”) rises, the TIPS principal value (or face value) is adjusted up, and vice versa when inflation falls. The coupon rate is based on the adjusted principal value, so a higher value leads to a higher coupon payment. At maturity, the investor receives the higher of the adjusted value or original principal amount.

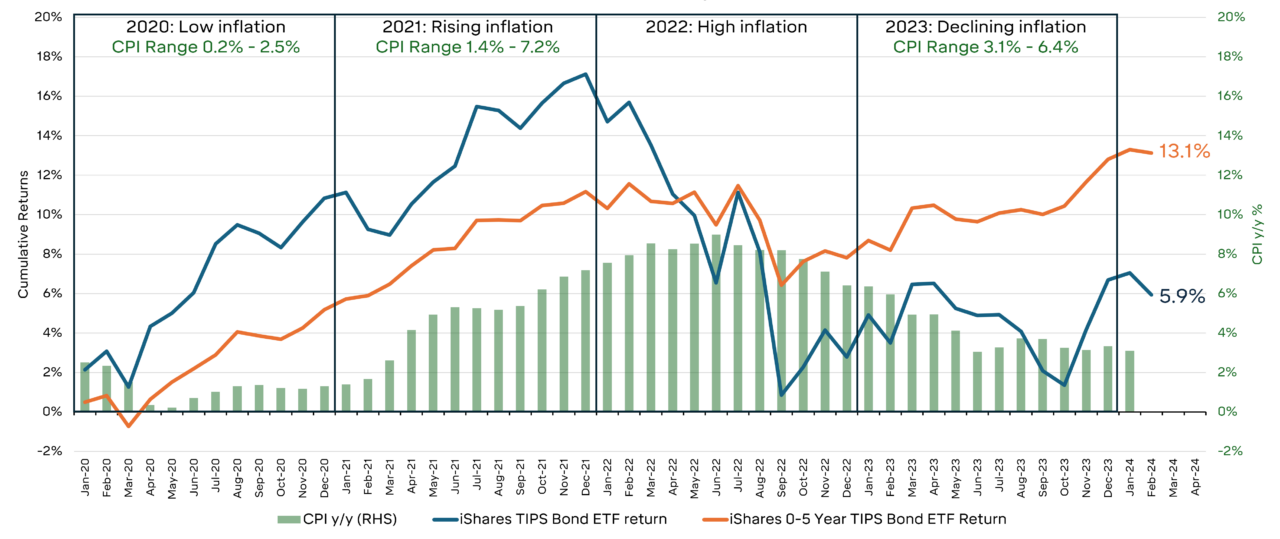

Two of the largest TIPS strategies in the marketplace are the iShares TIPS Bond ETF (TIP) and iShares 0-5 Year TIPS Bond ETF (STIP). The primary difference between the two is that TIP has an average maturity of about 7.5 years, while STIP has a shorter average maturity of 2.5 years. The chart below shows the cumulative return path of both TIPS products over the past four years, which is overlayed with the year-over-year CPI readings.

Cumulative Returns for TIPS ETFs

2020-Today

When investors needed TIPS the most (2022), both strategies had negative performance. Why?

The primary reason TIPS performed poorly is that while they provided some inflation adjustment, they are still bonds. And like any bond, TIPS prices are subject to the inverse relationship between interest rates and their price. When rates go up, as we saw in late 2022 and into 2023, the market prices of bonds go down, which harms their performance.

Next, principal value at maturity and market price aren’t the same thing. The principal amount adjusted higher as inflation rose, but that only matters at maturity. In the meantime, the value of TIPS fluctuated based on interest rate movements. So, while TIPS investors receive an inflation-adjusted higher principal value at maturity, their return before maturity is based on market value primarily driven by interest rates.

Finally, when you buy a TIPS, the starting price and yield reflect the expected inflation. If inflation turns out to be higher than expected (e.g., unexpected inflation), the TIPS will adjust higher and outperform. They do well if inflation grows beyond what the market expected when the TIPS was purchased. This dynamic played out in 2021, but by 2022, TIPS were pricing in higher inflation and the expected inflation adjustment was priced into the bond at purchase.

Investors shouldn’t dismiss TIPS as an ineffective portfolio tool for keeping up with inflation. A better understanding of their mechanics and performance drivers can guide investors to better outcomes by avoiding the temptations of market timing. The daily price fluctuations need not distract long-term and/or buy-and-hold investors from the ability to earn incomes tied to inflation and expected payouts at maturity.