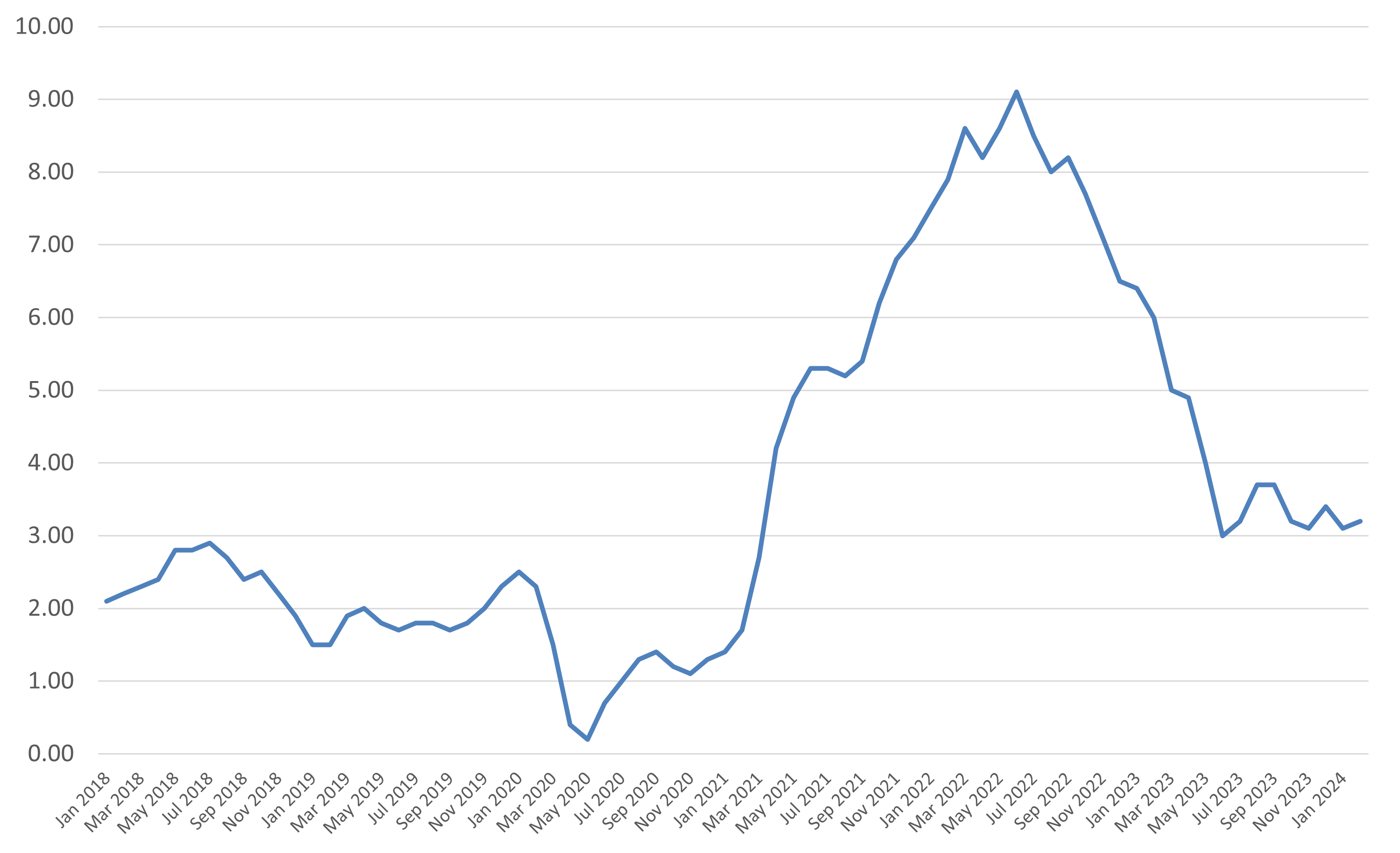

Inflation has been brutal over the past few years. After decades of running below 3%, starting early 2021, the Consumer Price Index increased rapidly as the economy opened back up after Covid-19 related lockdowns. It peaked at 9.1% in June 2022 and then declined to its current level of 3.2%, per Bureau of Labor Statistics data.

Inflation Rate (CPI-ALL)

Jan. 2018 – Feb. 2024

ST. LOUIS TRUST & FAMILY OFFICE DATA FROM BUREAU OF LABOR STATISTICS

Even though inflation has cooled dramatically, when I went to the grocery store this weekend to pick up a few items, I was surprised at how much a few bags of items cost. If inflation has been declining, why does everything still seem so expensive?

The Difference Between High Prices and Inflation

The first reason prices seem high even though inflation is coming down is that there’s a difference between inflation and prices.

According to the International Monetary Fund, “Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year.” For example, if a container of almond milk rises from $3.99 to $4.49 over 12 months, it has an inflation rate of 12.5% ($0.50 divided by $3.99). Now, after increasing in cost, almond milk is more expensive and likely to stay that way because the prices of most goods are sticky (once they increase, they usually don’t come back down). So, even if almond milk inflation goes to zero, when you go to the grocery store, you may think, “Wow — $4.49 for a carton almond milk? That’s expensive – I remember when it was $3.99.”

As inflation (hopefully) continues normalizing, the sticker shock you experience on certain items should ease as you grow accustomed to higher prices. However, realize that price levels resulting from the inflationary run-up are likely here to stay for most goods and services.

Personal Inflation Rates Differ

Next, inflation might feel higher than reported because the mix of goods and services you consume might have experienced higher inflation.

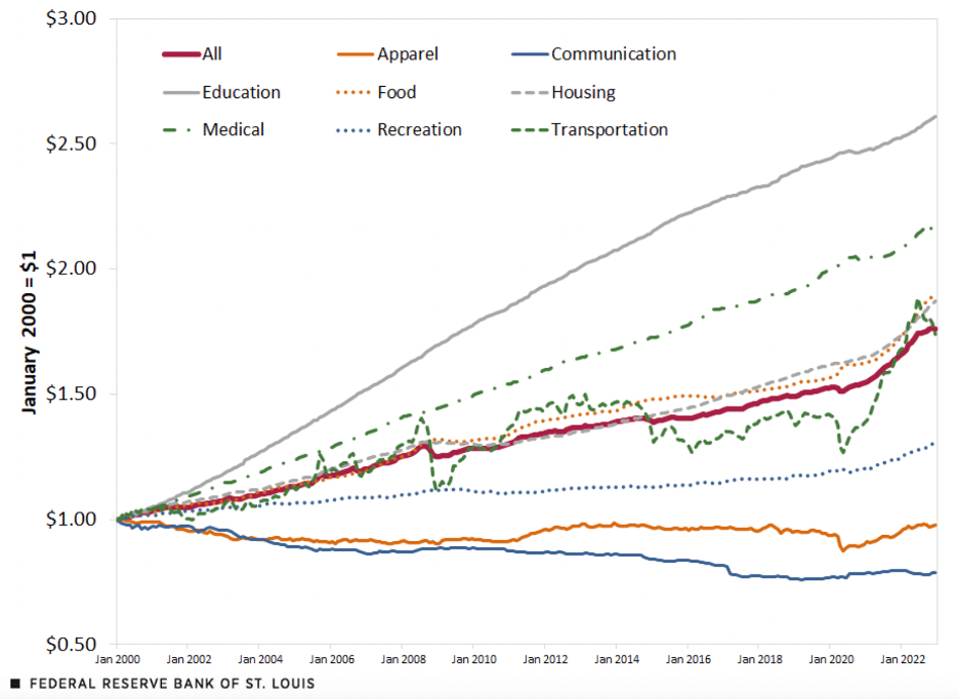

Inflation is typically reported as a single number. For example, the 3.2% inflation rate mentioned above is for the CPI on all items, which, according to BLS, “represents changes in prices of all goods and services purchased for consumption by urban households.” The CPI on all items is comprised of subcategories, including education, rent, food, energy, and others. Below is a chart from the Federal Reserve showing inflation rates from 2000 to 2022 for select subcategories.

Consumer Price Index by Expenditure Categories since January 2000

FEDERAL RESERVE BANK OF ST. LOUIS

You can see that some categories, like education and medical expenses, have significantly outpaced total inflation, while others, such as apparel and communications, have actually gotten cheaper.

This means the inflation you experience will depend on your mix of goods and services consumed. If you pay your child’s tuition, you’ll feel the sting of education inflation. If you own a house with a fixed mortgage payment, you won’t experience the inflationary effects of rent increases. If you have a short work commute, increases in gas prices won’t affect you as much as someone with a long commute.

The Focusing Effect

As noted in the prior section, some things we buy have experienced high inflation, and others have low inflation (or even disinflation). But psychological research suggests it’s human nature for us to focus on negative things, which in an inflation context means high-priced items.

For example, when it takes $40 to fill your gas tank after it recently cost $30, you notice that change. But when you buy a new dishwasher for not much more than the one you purchased 10 years ago (and the new one uses less energy and is twice as quiet), or when your new MacBook Pro costs less than you paid for your old one (and has twice the memory and eight times the processing power), that lack of inflation probably doesn’t register. Yet, these items with lower inflation are elements of the full measurement and they pull down the overall rate.

Adopt a Complete Mindset Concerning Inflation

Inflation isn’t pleasant – it stinks when consumers must pay more of their hard-earned money for the usual goods and services they consume. Despite the overall downward trend in inflation from its peak in mid-2022, consumers continue to feel the pinch at the checkout line.

Yet, it’s important to have an accurate handle on how inflation is exactly affecting your finances. Recognizing that your personal inflation reality may differ from the headline numbers can help provide perspective as the economy transitions to hopefully a lower, more stable inflation trend.