A “meme” is defined as an image, video, or piece of text, typically humorous, that internet users copy and which spread rapidly. Popular ones over the past few years are of a guy walking with his girlfriend but distracted by another girl. Various captions are placed on the three people and then spread around. Here’s one of them I just created:

We’ve all received memes or even created some. Memes have become commonplace in our social media culture and, in recent years, have entered the world of investments with the advent of meme stocks.

What are “Meme Stocks”?

Meme stocks are stocks that have gained viral popularity due to heightened social sentiment. Online communities on social media platforms (often Reddit) share research and promote specific stocks, generating much buzz and interest. The notorious meme stock craze of 2021 led to tremendous gains in a couple of stocks, notably GameStop [GME] and AMC Entertainment [AMC]. In 2024, meme stock investing has been revived as Trump Media & Technology Group [DJT] sees its share price ascend and grab headlines. (DJT has a market capitalization of $6.3 billion even though the company reported a loss of $58 million and just $4 million of revenue).

This begs the question: Can an investor have a profitable strategy for investing in meme stocks? The answer is probably not.

A good test case for meme stock investing takes us back to 2021 when GameStop and AMC Entertainment exploded in value due to interest in the stocks created by a subreddit group that became mainstream. (They even made a movie about this!)

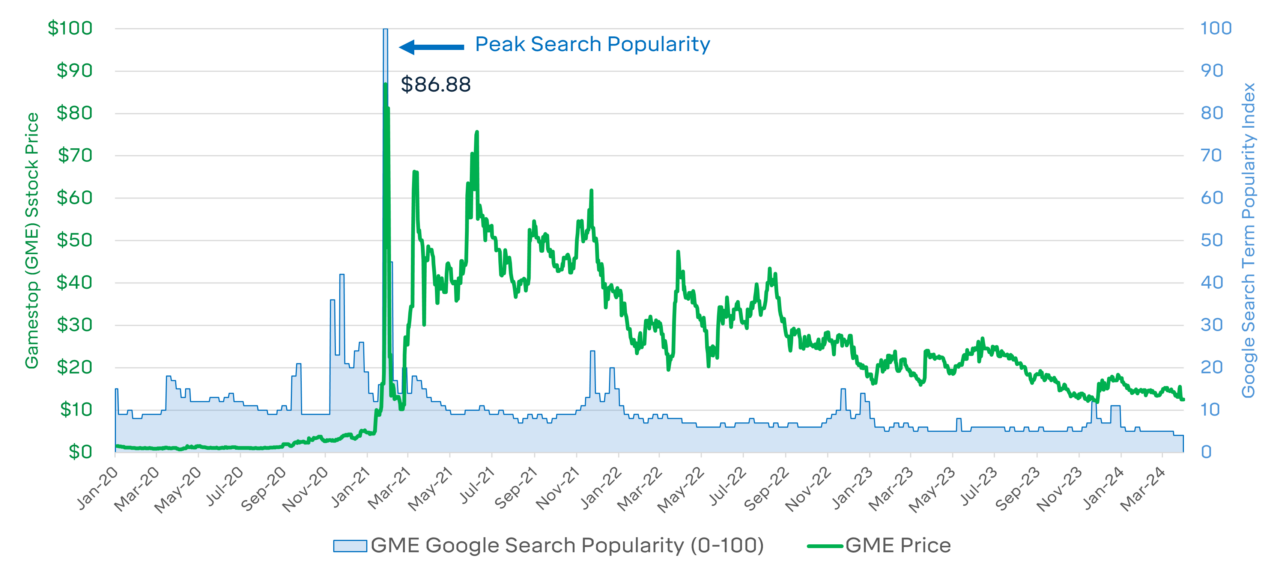

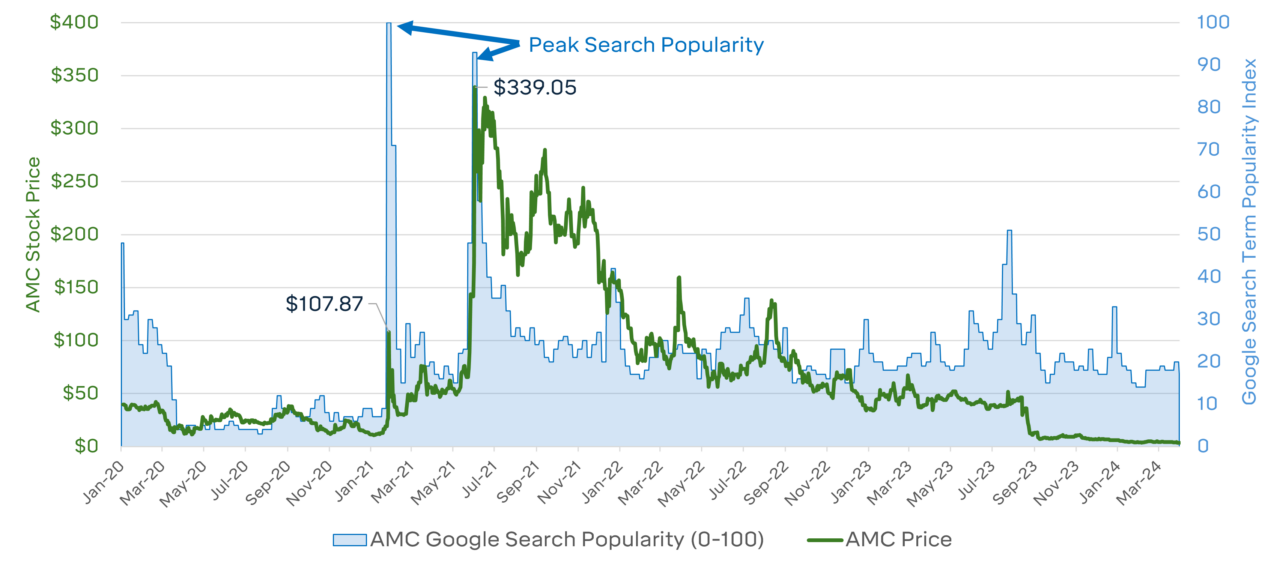

Below are two charts showing the share prices of GameStop and AMC, which illustrate their meme stock surge. As an added context, I’ve overlayed each company’s Google trends index, which shows search terms’ popularity (i.e., how often “GME” was searched for on Google). The index numbers represent search interest relative to the highest point on the chart for the given period. A value of 100 is the peak popularity.

GameStop Stock Price and Google Search Popularity

AMC Stock Price and Google Search Popularity

The charts show that share price peaks corresponded with crests in people searching these companies on Google. This isn’t to imply causation of one to the other but to point out that they coincide.

Meme Stock ETF

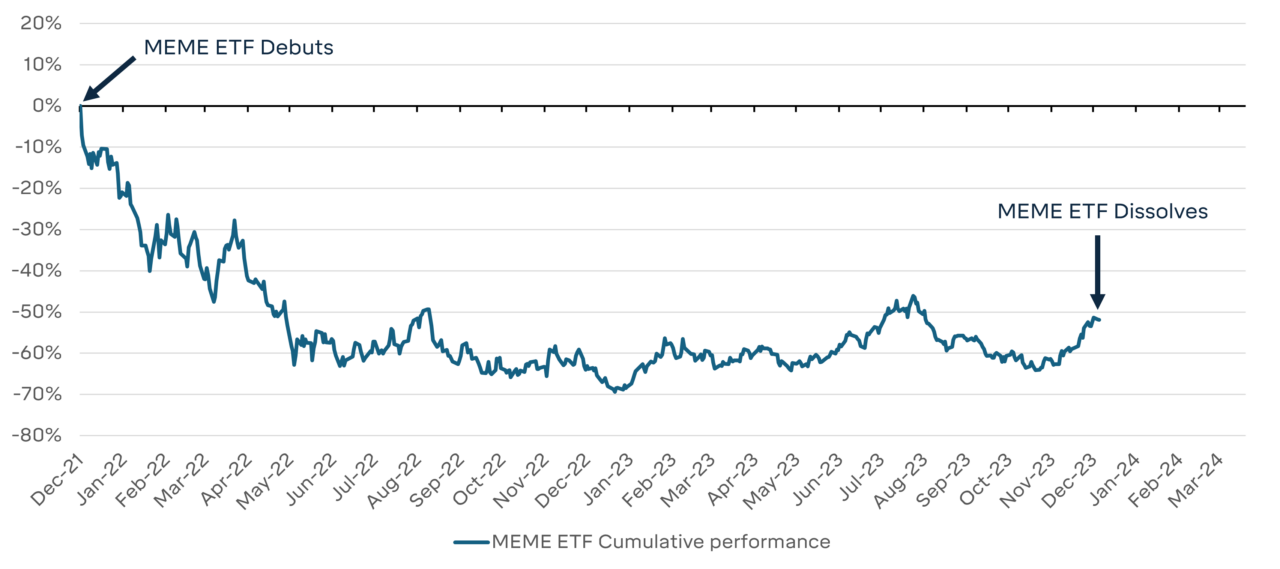

Wouldn’t it be great to have an investment product that would spot meme stocks and allow investors to profit in their run-ups? In the wake of the 2021 meme stock mania, such a fund was created to capture the zeitgeist of meme stocks and package them into an equally weighted portfolio of stocks with meme-like qualities. What better way to catch the wave of popularity than by investing in a popularity catcher?

But capturing meme stock lightning is difficult. Below is the disappointing performance of the MEME ETF from inception to its dissolution late last year.

MEME ETF Cumulative Performance Since Inception

It turns out that it is not easy to spot, catch consistently, package virality, and turn it into something profitable. And that shouldn’t be a surprise. Meme stock prices are driven by short-lived popularity rather than fundamentals, making any attempts at forecasting the performance near impossible. As with viral videos, there is a finite shelf life. It’s hard to know where and when it starts and how it ends. But it indeed ends. Investors are better off avoiding the temptation to ride the popularity wave and instead bask in the entertainment that it provides. By all means, please continue to share your memes via social media, but don’t let your portfolio near them.

(Full disclosure: In the spirit of placing an immaterial wager, I bought very short-dated AMC calls in January 2021 to ride the wave of meme mania on that stock. The next day, the NASDAQ exchange halted trading on the stock, given its excessive volatility, killing the tremendous social momentum that had been building. When trading resumed, the stock began its initial descent. Did I learn a lesson? Yes, market exchanges are buzzkills.)