A few weeks ago, I got a call from a friend who was frantic after she opened her June portfolio statement. She hadn’t looked at her account since the beginning of the year and was dismayed that it had lost about one-fourth of its value. She told me, “I’ve lost more money in six months than I make in a year! Maybe I shouldn’t own so many stocks. What should I do?”

I analyzed her portfolio and noted that even with the recent decline, her investments had paid off nicely over time. I told her, “Even with the recent drop, your portfolio is still 25% above where it was two years ago and more than double where it was ten years ago. You’ve done well, and to enjoy the ups, you must weather the downs.” With this change in perspective, she felt better, and we had a calm discussion about the appropriateness of her asset allocation (which is probably too aggressive given her risk tolerance).

My friend is not alone in feeling like she’s lost money even though her portfolio is way up—it’s common to feel that declines from high-water marks are losses. These days, most of us are in that same boat; we’ve (hopefully) enjoyed many years of gains on our stock investments but now find our portfolios down from their highs (I wince when I check my investment account, remembering its value at the beginning of the year.)

Comparing the current value of a portfolio to its high-water mark is not productive. A decline in value, even if the portfolio has performed well over the long-term, generates fear and anxiety and makes practicing good investment behavior more challenging.

What to Do Instead

Instead of comparing your portfolio to a recent higher value, step back and try these strategies instead:

1. Zoom Out. Over the short term, investment markets are unpredictable and chaotic. News, events, and investor psychology (meme stocks, anyone?) cause the market to gyrate, surge, and fall. But over the long term, the market consistently provides positive returns.

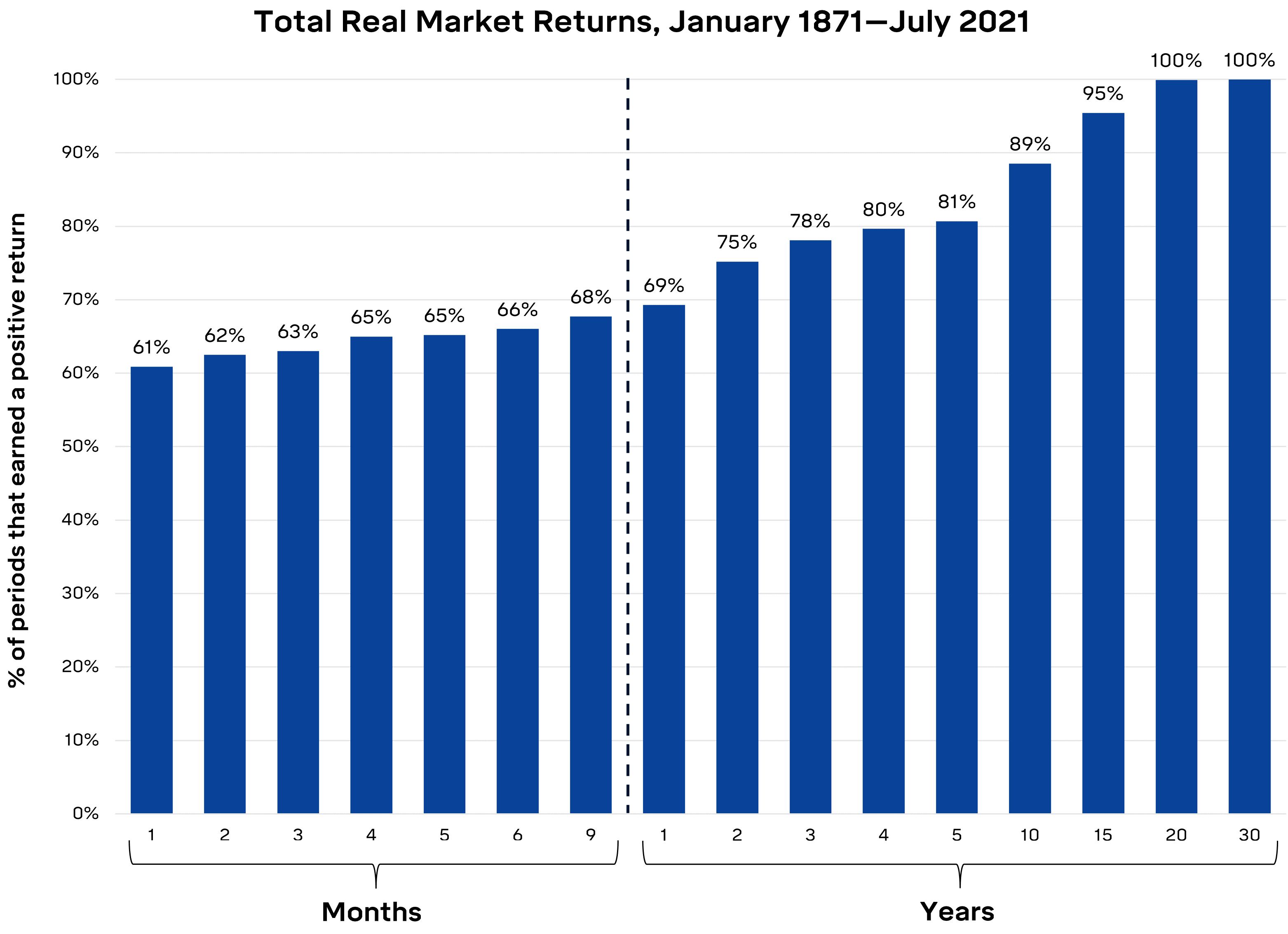

Since 1871, the stock market has delivered a positive real return 100% of the time over 20-year periods and 89% of the time over 10-year periods. But over shorter timeframes, the stock market is much less consistent, delivering positive quarters 63% of the time and positive daily returns just 55% of the time.

ST. LOUIS TRUST & FAMILY OFFICE

Like I did with my friend in the example at the beginning of this article, do some research to find the value of your portfolio five and ten years ago. If you have been consistently adding to your investments and buying stocks in a diversified manner, your portfolio likely has grown nicely over those more extended periods. Realizing this will help quell the anxiety recent declines may have caused you.

2. Be Aware of Two Cognitive Biases that Aren’t Helping. A few biases are partially to blame for the pain we experience when the stock market drops from a high-water mark.

The first is loss aversion, the theory that people experience the pain of loss about twice as strong as the pleasure they feel amid a gain. This asymmetry is part of the reason we react strongly when we suffer a financial loss. So, seeing our portfolio down from a high-water mark causes us anguish, even if it’s up over the longer term.

Another is the concept of anchoring, which occurs when we have a particular number or starting point in mind. Investment manager James Montier likes to ask people to write down the last four digits of their phone number (you may want to do this now) and then asks how many licensed physicians there are in London (go ahead, take a guess). He finds that “those with telephone numbers of 7,000 or higher think there are around 8,000 doctors working in London, while those with telephone numbers of 3,000 or lower think there are around 4,000 doctors in London.” How many doctors are there in London? About 50,000.

What anchoring bias teaches us is that we cling to numbers, sometimes subconsciously. Thus, if we see our portfolio is worth $1 million, that number sticks in our heads, and any decline feels like a loss.

3. Focus on Your Investment Plan. When you experience the painful emotions of shrinking portfolio values, it’s best to fall back on your documented investment strategy. An investment best practice is to have an “Investment Policy Statement” (or “IPS”) where you document investment strategy and asset allocation. Your IPS will provide guardrails for your behavior and improve your returns.