Being a bond investor over the past two years has been brutal. The bond market, as measured by the Bloomberg Aggregate Index, declined 13% in 2022 and is down another 2.5% so far in 2023. Adding insult to injury, bonds fell in tandem with stocks in 2022, robbing investors of their usual option of rebalancing from bonds to stocks when equities decline.

Before 2022, bonds enjoyed a 40-year bull market. They only experienced annual declines in four of those years (1994, 1999, 2013, 2021), with the worst result being a negative 2.8% return. So, 2022’s 13% decline is an off-the-charts event.

Two converging factors caused the unprecedented negative performance:

- Rising Rates. From Q1 of 2022 to Q3 of 2023, the Federal Reserve raised the Fed Funds rate from near zero to 5.25%-5.5%, and the yield on the 10-year Treasury jumped from a mere 1.6% to nearly 5% during that same period. As explained below, because bond prices move inverse to interest rates, the substantial jump in rates caused a collapse in bond prices.

- Low Yields. Bond yields provide a cushion against price declines caused by interest rate increases. Entering 2022, bond yields were meager, with the 10-year Treasury yielding only 1.63%. So, bond prices took the full brunt of the interest rate rise with almost no yield cushion.

But instead of gnashing their teeth and bemoaning the recent higher rates, bond investors should be celebrating their rise in rates for two reasons: Bonds issued at lower rates will regain their value; and high interest rates, more so than falling rates, drive bond returns — meaning it’s the best time to buy bonds since 2007.

The Par Value Tractor Beam

Bonds lose value when rates rise. Let’s say you bought a 10-year Treasury bond for $100 at the then prevailing rate of 3%, but now Treasuries of the same maturity trade at a 4.5% yield. Your bond and another one offering 4.5% are identical, except your bond yields 1.5% less. Because the market demands a 4.5% yield and yours only pays 3%, if you sell your bond, it will be at a discount so that the buyer will earn a 4.5% yield from purchase to maturity.

The opposite situation occurs when rates fall. If the prevailing rate for your bond falls to 2%, then your bond paying 3% will garner a premium if you sell it.

But if you don’t sell your bond, then the change in interest rates won’t affect your return because bondholders are paid back par value at maturity. So, like how the Death Star had a “tractor beam” that could lock onto spaceships and pull them into a hangar bay for capture (you might remember this happened to the Millennium Falcon), a bond’s par value also acts as a tractor beam, pulling the price of the bond up or down to par value.

The chart below shows how the price of a hypothetical bond might move over its lifetime during a rising (blue) or falling (green) rate environment. Note how both bonds start and end at par value—an intense tractor beam.

Price of Hypothetical 10-Year Bonds Over Their Lifetime

During a Rising and Declining Rate Environment

Thus, while bond returns have been ugly, it’s important to remember that bonds are a different beast than stocks. Stocks can decline and languish for years (like Under Armour, down about 85% from its peak eight years ago) or go to zero (like Bed Bath & Beyond did recently). Bonds are different. Unless a bond defaults (an exceedingly rare occurrence for investment-grade bonds), at maturity, the bondholder is paid par value.

I’m not saying bond price fluctuations don’t matter. They do. Had bonds held their value in 2022, investors could have sold them to buy stocks when they were down. But don’t fret too much if you are a bond investor sitting on significant losses. Unless you sell your bonds, the loss is only on paper.

Yields are What Primarily Drive Bond Returns

Bond investors love to cheer falling rates because they boost bond prices. Hence, a common notion is falling interest rates drove the 40-year bond bull market. Sure, declining rates can juice bond returns if sold before maturity. But the primary determinant of bond returns over the longer term is yield, not price changes due to interest rate movement. So, having higher rates is better for bonds over the long term.

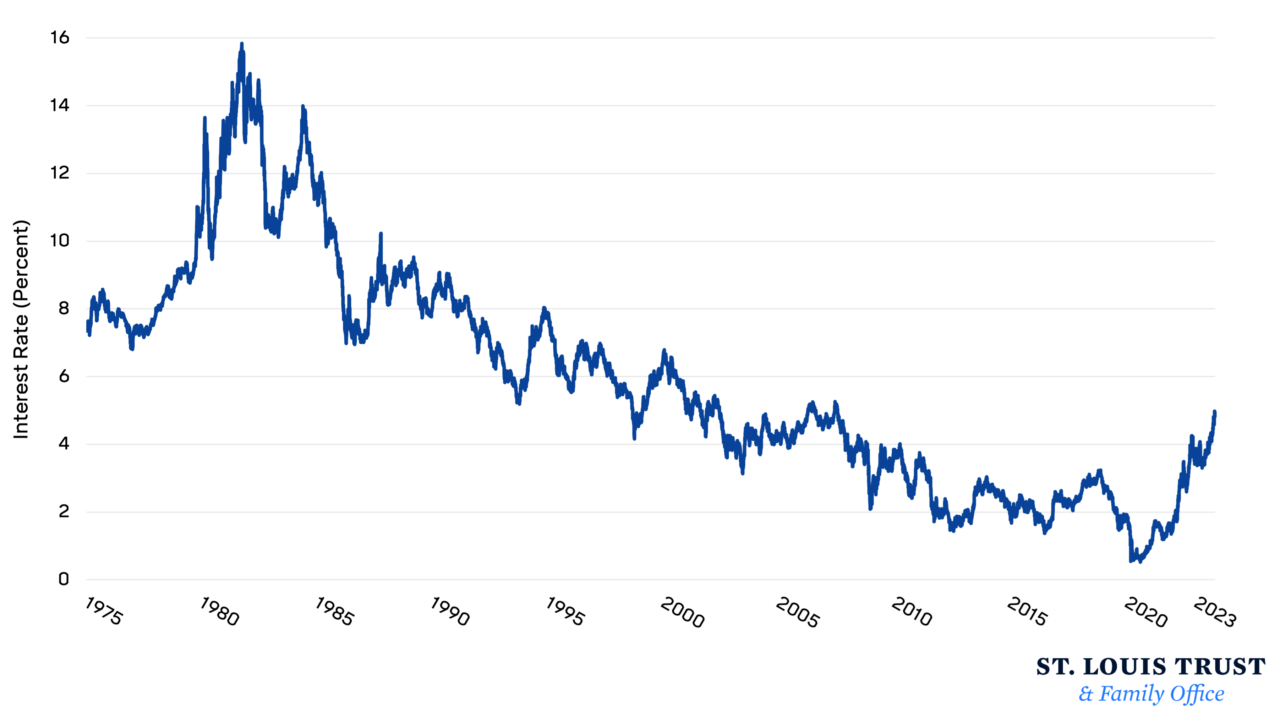

To understand this point, consider the below chart of the yield on 10-year Treasuries from January 1975 to October 27, 2023. Yields topped out at 15.8% in late 1981 and declined to a low of 0.52% in 2020.

10-Year Treasury Yields

January 1975–October 27, 2023

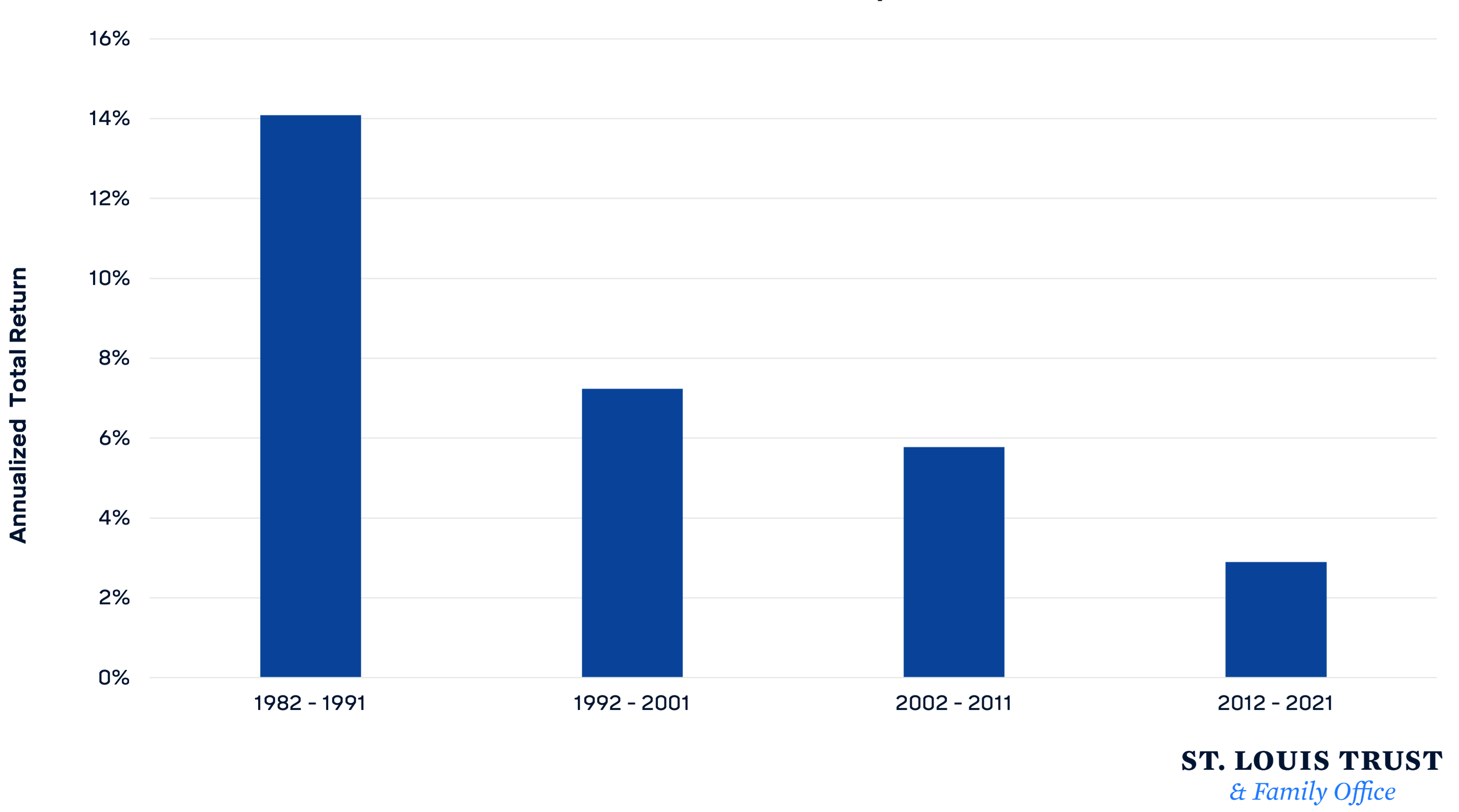

While there are ups and downs, you can see that 1982 to 2021 was a period of continually falling rates. How were bond returns during this falling rate period? The Bloomberg Aggregate returned a solid annualized 7.42%. But as the chart below shows, the total return fell each decade, with the first decade of the 40-year period notching an impressive 14.09% return and the last decade returning a mere 2.9%.

Bloomberg Aggregate Bond Index

Annualized Total Returns by Decade

The returns declined each decade because the falling rates led to lower starting yields. This makes sense. Suppose you paid $100 for a 10-year Treasury bond in 1982, yielding 15%. You would have enjoyed $15 of interest on your $100 bond every year that you held it (earning you $150 of interest on your $100 investment if you held it to maturity). Sure, your bond would have increased in value on paper because of the decline in interest rates over the decade, but the price increase doesn’t matter unless you sold it. And what if you sold it when rates had declined to, say, 10%? You’d make a tidy profit. But when you reinvested your proceeds into new bonds, they would yield that lower 10% amount. So you wouldn’t be any better off.

Compare that 15% yield bond scenario to 30 years later in 2011, when the 10-year Treasury yielded 3%. That starting yield isn’t great, so your returns won’t be great. Sure, falling rates after 2011 added to your returns if you sold before maturity, but given your starting point of a paltry 3% yield, you can’t expect to earn much on your bond.

Even if you followed a trading strategy to take advantage of the falling rates, your long-term return is still primarily driven by the starting yield. For example, Newfound Research ran a simulation in 2017 where “10-year Treasuries are bought at the beginning of each year, held for a year, and sold as 9-year Treasuries. The proceeds will then be reinvested back into the new 10-year Treasuries.” They ran the test from December 1981 to December 2012 and found the starting yield accounted for 71% of return and price changes for only 26% (the other 3% was “roll yield”).

What This Means for Bond Investors Today

The decline in bonds’ value over the past two years is a bummer. But don’t panic, bond investors. Your current bonds (or bond funds) showing losses won’t stay down — the par value tractor beam will pull up their returns. And because higher yields mean higher returns for bonds, the recent rise in interest rates is good news for the future returns of long-term bond investors.