For much of the past 15 years, investors treated “bond” as a four-letter word. Owning bonds was like having parsley sit next to the delicious entrée of stocks. I’m sure it makes the plate look better, but I don’t need it taking up space, thanks. Bonds haven’t been the investment of choice when it comes to significantly growing your wealth. You essentially owned them to preserve capital or to meet any future liabilities that came your way. But today, that parsley has turned into something more appetizing, given higher interest rates and yields that have emerged. Are we at a point in time when investing in bonds may be more attractive than stocks?

Trying to guess which asset class will perform better in the future and over what timeline is incredibly difficult, despite the certainty and conviction your favorite market strategist will convey. However, that doesn’t mean it’s a worthless exercise as there are ways to break down bonds and stocks into a value metric and determine if they are under- or over-valued relative to each other

One method of comparison simply looks at a bond’s, (or bond indexes’) yield-to-maturity (YTM) and attempts to equate that to a yield for a stock. Breaking down these into their comparative elements takes a little work.

The fascinating thing about a bond’s YTM is that it tells you the actual return you’d receive from this point in time if held to maturity. How? With a bond, you know the terminal value (what it pays out at maturity), the timing and amount of cash flows (via the coupon rate and payment), and the price at purchase (what you paid). From there, math takes over and, absent the issuer failing to pay or going under, voila, you have your predicted return!

For stocks, predicting future returns is harder. There is no magic math to get us to a known outcome as with bonds. Instead, we rely on a host of measures to predict returns, such as valuations, growth rates, dividends, and astrology (I may have made one of those up…). Given there is no yield-to-maturity for a stock, a close comparison would be to determine what a yield in general would resemble. This can be estimated by projecting what a share of stock will generate in earnings and dividing by the price of the share. Call it the Earnings-to-Price ratio, or E/P. Which looks like an inverse of the popular stock valuation metric P/E (price-to-earnings), and you know what, it is!

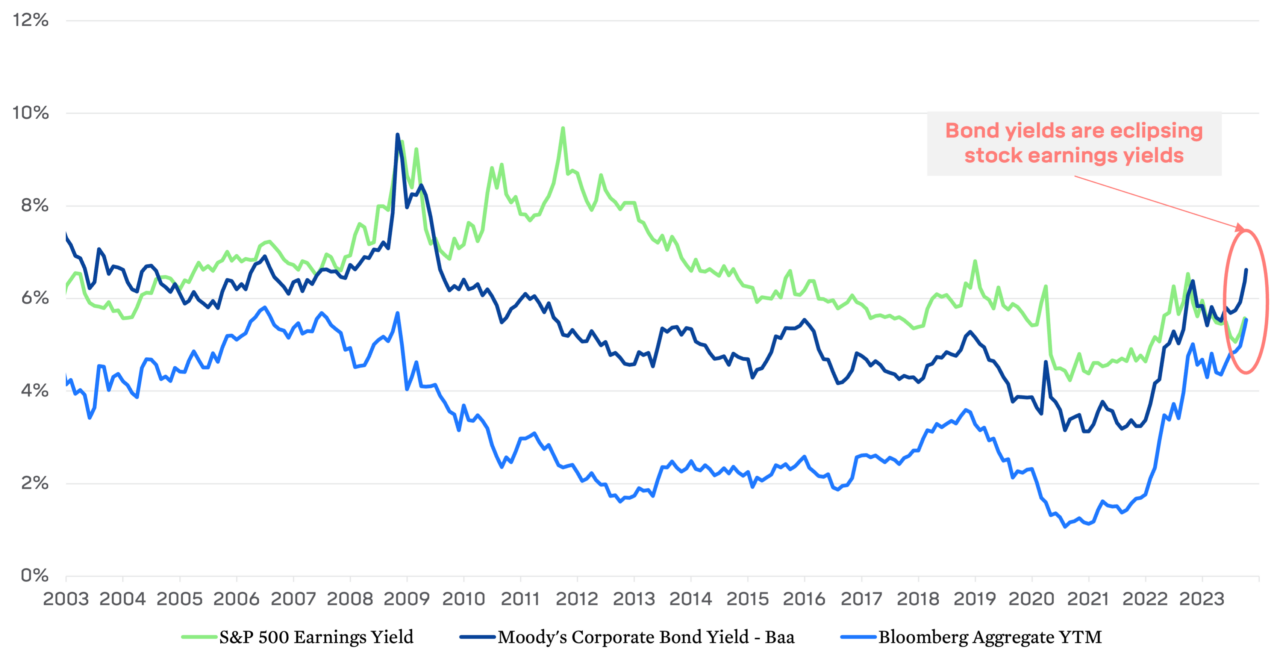

The chart below shows the earnings yield on the S&P 500 Index (blue) against two bond indices – Moody’s Corporate Bond Yield, Baa (a corporate bond universe) and the Bloomberg Aggregate (the broad bond market proxy), represented by the green and purple lines.

Stock Earnings Yield vs. Bond Yields

2003–2023

A higher yield is more appealing to an investor, no matter the investment, as it implies better value. As it stands today, the YTMs on the corporate and broad bond indexes are sitting at or higher than the earnings yield on the stock market. That hasn’t been the case for the broad market going back 20 years and the corporate market since 2009. Welcome back, bond yields!

What to make of this? It’s one comparative metric in a sea of plenty. When market pundits posit that bonds are better than stocks right now, they may be referring to a version of this analysis. It is hard to know what the stock market will do in the future as numerous variables and unforeseen developments could influence that performance. It doesn’t have math to fall back on like the bond market does. Acknowledging this known vs. unknown matchup should give anyone hesitation before making broad allocation shifts. Let’s instead welcome the return of bond yields and all their predictive glory to our menu of investments.