There are certainly things in life that are getting more expensive – housing, medical care, education come to mind for sure. But then there is the Amazon-effect of various consumer items that has either kept a lid on prices or driven them down across numerous categories of day-to-day and discretionary items. I love the fact I can get a new TV today with 10x the features for ½ the cost compared to a TV from 10 years ago. In some cases, we don’t need disruptive innovation to drive down the cost of goods. All of us have been to the grocery store and seen the premium product sit right next to the store’s private label version at a lower cost. I always find myself comparing the ingredients between the two to make sure I’m interpreting it right – why would anyone buy the same thing for a higher price? Is branding that powerful? (side note – yes, marketing folks, I agree that branding can be powerful. It’s just wasted on me.)

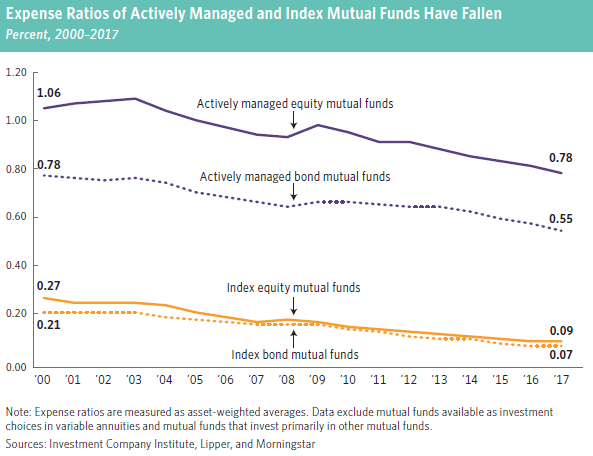

The investment industry has had creative innovation in financial products over the years. Most of the innovation occurs with complex financial products that explore unique corners of the investment universe in a variety of strategies. These products tend to come with fee profiles that reflect the complexity or uniqueness of their offering. At the same time, the industry has seen a sustainable trend in discounting for its core products – stock and bond mutual funds and exchange-traded funds (ETFs). The following chart shows the downward trend in expense ratios for stock and bond funds that are professional managed (purple lines) or simply tracking an index (orange lines).

It wasn’t uncommon years ago for an investor to purchase a mutual fund with a management fee of 1% or higher and be levied additional fees that could qualitatively range from absurd (like “front end load” fees) to slightly offensive (12b-1 fees). An investor’s all-in cost to access an equity mutual fund could end up costing over 6%! (depending on the share class). Fortunately, that era is being competed out of existence thanks to two major, concurrent forces that are shaping the industry – the ETF and Vanguard. One of these was a product innovation (ETF) and one remains what I call a ‘movement’ (Vanguard). Both were instrumental in packaging stocks and/or bonds into investment vehicles with costs well below the industry standard.

There are few controllable things when it comes to investing. You can’t predict or control the markets or future returns. You can control costs. And the costs continue to come down for investment products. Next time you look at your investment portfolio, take the time to shop and compare. There might be a nice, lower cost ‘generic’ product that offers similar exposure. Because sometimes you don’t need to pay for brand name (and brand fees) to get what you need.