Time as an Asset

My fandom for billionaire Mark Cuban goes back nearly two decades. Aside from the fact that he and I are both proud Indiana Hoosier alums, I find his business savvy and thought process fascinating. Years ago, I heard him say that the most valuable asset he owns is time. This is a billionaire who owns a professional basketball franchise, stakes in numerous businesses across many industries and (I’m guessing) lots of luxury homes, cars, planes, etc. As Mark says of time – “You can’t buy it. You can’t find it. You can’t store it. You can’t trade it.”

The first time I heard him say it, I did the standard casual nod of agreement <huh…makes sense>. But then I thought about it more and started to internalize what that could mean if I prioritized aspects of my life by this concept. If time was really the most valuable asset one could own, how do you get more out of it?

The Efforts to Gain More Time

I lived in Boston for years and anyone who has lived and commuted on the East Coast can relate to how much time is spent in cars or mass transit getting from point A to point B. I can honestly tell my grandkids one day that I walked a mile to work each way, after taking a 30-minute train ride, rain or shine. From door-to-door it was an hour. When I moved (back) to St. Louis, I was fortunate enough to cut my daily commute time down to under 10 minutes. I felt like I gained almost 2 hours! To me, that was a more important asset that anything I owned.

It’s amazing to think of how technology or innovation have transformed our lives over the last few decades, particularly how it relates to how we spend our time. The smartphone alone has made us more productive, efficient, aware, and informed – most important, it’s given us the option to save time on tasks that would sneakily eat up minutes in the day that could otherwise be used better. (Yes, the flip side is that smartphones and the apps that live in that universe have enabled us to be consumed by ‘time-wasting’ activities).

The other time saving routine that has collectively entered our lives is Amazon and the ship-to-the-door feature that has eliminated time-consuming trips to the store. Between the smartphone and Amazon, we have gained the ability to bank more time.

The Efforts to Use More Time

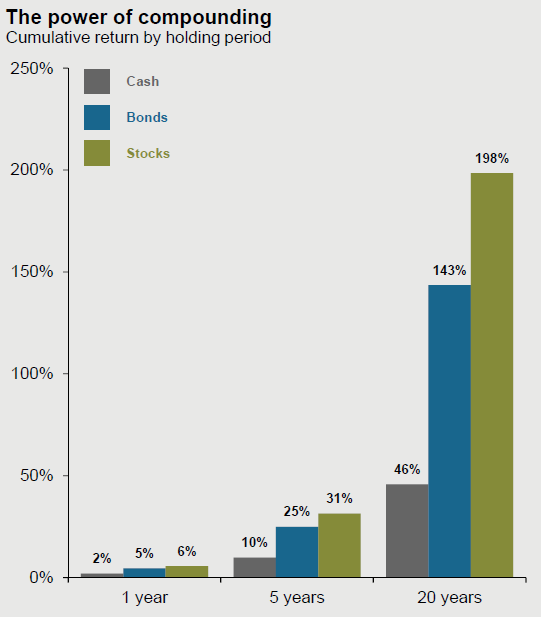

As an investor, it can be really hard to successfully invest in the best companies or earn consistently high returns. To be a great investor, you usually need to have some informational advantage (know things that aren’t widely known), an analytical advantage (be able to analyze or connect the dots better) or let’s be honest, a string of good luck. These advantages are harder to come by as the amount of talent swells in the investment industry and each newly-minted MBA or CFA is now taking those perceived advantages to the same opportunity set as others. Fortunately, knowledge or analytical skill isn’t an investor’s most important asset. It’s actually time. While we try and work at making the most out of our time in life, we can equally exploit that asset and take on investing with the longest time horizon. The below chart is a simplistic way of showing how longer periods of time work to the advantage of an investor. The key element being that, historically, stock and bond markets have rewarded those who stay invested and allow their investments to compound on themselves over years.

Making Time Work For You

The beauty of all of this is that exploiting a longer time horizon will end up buying you more time in life. Gaining financial security can lead to affording and utilizing services that shift the time allocation from task to leisure. And since time itself is a fixed resource, being able to enjoy it sure seems better than the alternative.