When considering how to live a more authentic, meaningful life, most people think of things like spending more time with family, doing volunteer work, or giving money to charity. But in recent years, a rising trend has provided another option: values-aligned investing.

The practice of aligning your investments with your values is nothing new. For centuries, some Jewish, Muslim, Quaker, and Methodist communities have avoided investments in businesses that violated their faith. Since then, many investors have continued to exclude “sin stocks”— companies that engage in activities viewed as immoral or unethical, such as alcohol and tobacco production, gambling, and weapons manufacturing.

Until recently, exclusion was the only way to align your portfolio with your values. Today’s investors have many more options. In response to growing concern about environmental, social and governance (ESG) issues, companies are adapting and the financial industry has created hundreds of new products. As of year-end 2021, $8.4 trillion in US assets under professional management (AUM) were using sustainable investing strategies, per the US SIF Foundation. This now represents 13% — or 1 in 8 dollars — of the total US AUM.

Although this presents a major opportunity for investors, the explosion of options has also made vetting these investments more challenging. How do you find the funds that best support your values? Which companies actually uphold the values they say they do? And how much impact can this type of investing really make? In this article, we’ll answer these questions, starting with how values-aligned investing works, how these kinds of investments perform, and what to look for as you get started.

How it works

When considering any new investment for a client, we always look at whether the investment will complement their portfolio and support their long-term financial goals. For clients interested in values-aligned investing, we also consider how companies’ business practices impact their stakeholders, including their employees, customers, suppliers, community, and the environment.

Before making a recommendation, we ask two additional questions: Does this investment align with our client’s values? And will it have the impact they’re seeking? The answers to these questions will vary by investor, and one person’s values-aligned portfolio will look much different than someone else’s. For example, investors who feel strongly about gun control may exclude holdings in firearms manufacturers, whereas others may hold outsized investments in these companies.

That’s what makes this kind of investing so personal, and why it requires identifying the issues you care about most. You also need to consider the level of impact you want to have. Are you interested in values-aligned investing for personal reasons? Perhaps you feel uncomfortable with the disconnect between your values and the types of investments you own. Or do you want to advocate for change? Or both?

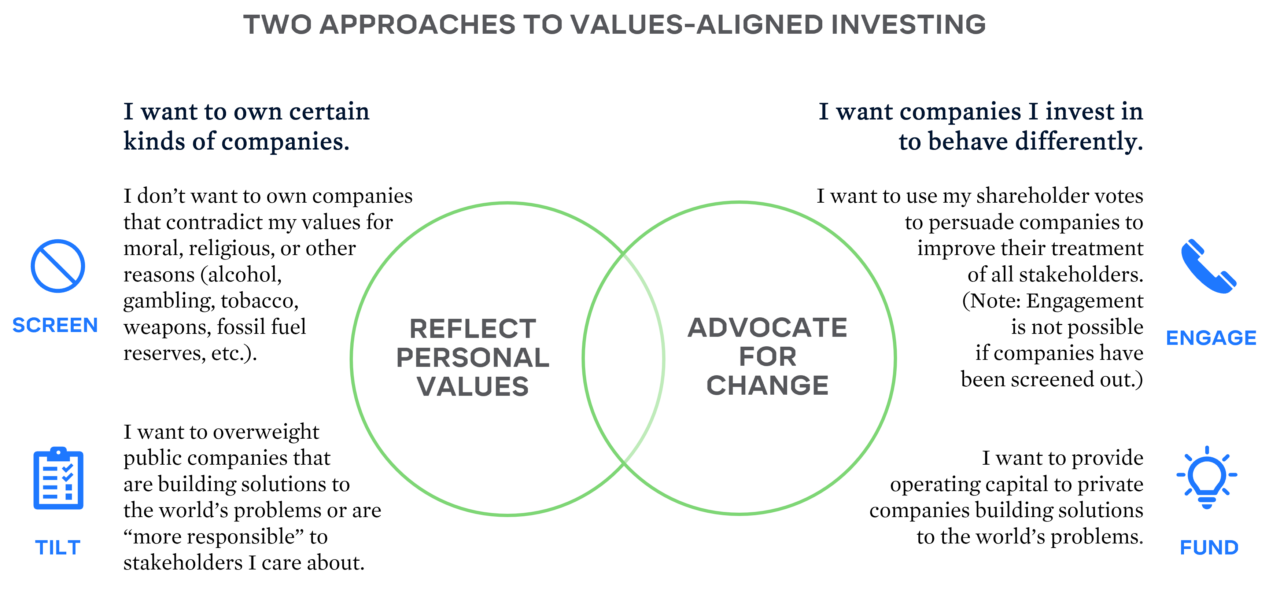

Depending on your objectives, you can use one or more of the following methods:

- Screen: To exclude or divest holdings in companies, sectors, or countries involved in activities that don’t match your values, such as excessive carbon emitters and companies without diverse leadership.

- Tilt: To invest in companies building solutions to solve the world’s problems or with stronger ESG track records than peers. For example, investing in companies with lower greenhouse gas emissions or more women in leadership than their competitors.

- Engage: To invest in shareholder advocates — managers who strive to influence corporate behavior through shareholder resolutions, voting proxies, and direct contact with company management. For example, Home Depot phased out selling wood obtained by clear-cutting old-growth rainforests after pressure from its shareholders.

- Fund: To provide operating capital to private companies focused on addressing ESG issues, such as wind and solar power operators and real estate firms focused on affordable housing. These investments typically require higher minimum investments than public market investments, costing $250,000 or more for a fund that invests in several private companies.

These methods fall within two broad approaches as the below diagram illustrates:

For those who want to align their investments with their personal values, screens and tilts will help. However, screens and tilts are unlikely to influence corporate behavior unless nearly all investors take similar action, such as a significant divestment campaign. Engagement and funding are better options for those who want to use their investments to effect change. You can also use a combination of all four methods to pursue both objectives.

What about returns, fees, and taxes?

Some people are apprehensive about values-aligned investing because they think they’ll have to sacrifice returns. But in many cases, the returns on values-aligned investments are comparable to traditional investments with similar risk profiles. We hold values-aligned funds to the same performance standards as all other investments for clients. In addition, we care about whether they are following through with their screen, tilt, engagement or impact plans.

Another factor to consider is fees. Many values-aligned fund managers charge higher fees than traditional managers. Those higher fees can be justified if a manager engages with companies to advocate for change or if a fund’s returns meet expectations after accounting for fees. We avoid funds that charge higher fees without those benefits.

Making changes to your portfolio often has tax implications. How do you shift your investments to align with your values without generating a large tax bill? Tax managing a portfolio is generally a timing game – determining whether to pay sooner or later. To reduce near-term taxes, use either cash or proceeds from selling positions at a loss. But if you have a fully invested portfolio with a hefty unrealized gain, many of our clients make small changes over time to spread out the tax cost.

5 tips for success

Values-aligned investing may sound simple enough but getting started can feel daunting. If you would like to invest this way, the following five tips will help simplify the process and set you on the right path.

1. Identify your values and your goals first.

As with any change, you’re unlikely to stick to it if you aren’t clear on your purpose. Think about what matters to you and whether you care most about aligning your investments with your values or effecting change (or both). There are no wrong answers to these questions. From this starting point, we help our clients design a values-aligned portfolio.

2. Use fund managers who do their homework.

One of the first things to be wary of when pursuing values-aligned investing is greenwashing — companies and funds that market themselves as more ESG friendly than they really are to attract consumers and investors. The SEC and European regulators are working on rules to help limit this practice, but for now, it’s important to look beyond how funds are labeled and marketed when choosing values-aligned investments.

Even when funds are following the process they’ve outlined, funds aren’t always transparent about their stock selection criteria and some use data shortcuts. For example, some managers rely on ESG ratings from data providers such as MSCI or Sustainalytics to create their values-aligned funds. However, these ratings can vary widely, even for the same companies, because of differences in how the data providers use and weight the data. Others zero in on specific ESG data points for each company that are material to the industry and construct their own analysis frameworks.

To address greenwashing and data challenges, we prefer that our clients invest with public fund managers who have extensive ESG data experience, subscribe to multiple ESG data sources, and use their own analysis framework. To ensure we’re recommending high quality funds to our clients, we hired Align Impact, a values-aligned investment consulting firm. We rely on Align Impact to source investment opportunities, conduct due diligence, and monitor whether funds continue to meet their financial and impact goals.

3. Strive for progress, not perfection.

It can be harder than you’d think to determine whether a company is a positive or negative force in the world. Because no business is perfect, you might have to prioritize one value over another or settle for “good enough” when choosing investments.

For example, many people applaud Tesla for leading the way in curbing climate change by shifting the auto industry from fossil fuels to electricity. But Tesla has also been criticized for tolerating sexual harassment, having a mandatory arbitration policy for employment-related claims, and refusing to disclose data on the diversity of its workforce.

If social equity is your top concern, you may opt to avoid funds that include Tesla or invest with a manager willing to push the company to uphold higher employment standards. When making these values decisions, the goal is to find investments that check your most important boxes, not all of them.

Values-aligned investing requires patience and focusing on the bigger picture. It’s intended to complement other ways to improve the world, not replace them.

4. Manage your expectations.

Many of the world’s biggest problems can’t be solved by the capital markets alone. Reversing a phenomenon like climate change will require collective action by governments, corporations, investors, and individuals. And when profit motives are at odds with eradicating an environmental or societal issue, progress can be slow.

It can take years for shareholder resolutions to compel companies to adopt more sustainable practices and just as long for a startup to build, test, and launch a world-changing product. Values-aligned investing requires patience and focusing on the bigger picture. It’s intended to complement other ways to improve the world, not replace them.

5. Pace yourself.

The larger your portfolio, the more options you have for incorporating values-aligned investing into your investment strategy. However, every asset class offers these kinds of opportunities, so you can adjust your portfolio regardless of its size. To keep it simple, you might begin with one values-aligned investment or focus on a single asset class, then make more changes as you become increasingly comfortable. Shifting to a values-aligned portfolio is a process, so move at the pace that works best for you.

The way forward

If this kind of investing interests you, the first step is to identify your core values. Are you more concerned about climate change or human rights? Clean water or equal pay? Access to healthcare or affordable housing? Some people have ready answers to these questions. Others have a long list of concerns they find difficult to prioritize. To identify your top two or three issues, start by filling out this worksheet. Having professional guidance can also help jump start the process. Contact your St. Louis Trust & Family Office advisor to explore the best options for you.