A relative worked for a publicly-traded company for the last couple decades of his career. Let’s call it “Company X.” Throughout that time he had invested some of his money into that company’s stock and would closely follow any news related to the company or stock price. He’d often relay specific news items about the stock to me – “Hey, did you see that Company X is doing an acquisition? They say it’s going to be great for the stock.”

At one point I asked him if he ever planned on selling some of his position and diversifying. The stock had been doing very well over the past few years, and the stock price continued to trend higher. His response was “Why should I? ‘They’ say the price is going to $120” (it was around $100 at the time).

Being in the investment industry, I immediately knew who he referred to as “they” – the professional stock analysts that cover the company, writing detailed investment reports and providing them to professional and retail investors. These analysts tend to work at large investment banks and sell their research on companies to various firms in the asset management industry. As part of their research, they always provide a ‘price target’ (Company should be worth $XX/share) or rating on the stock that generally falls into the Buy, Hold or Sell category. As you’d expect, Buy ratings are given to companies where the analyst believes the price will be higher than today and vice versa. In the instance of Company X, the consensus rating was a Buy, and the price target was $120/share at the time. But do these ratings or consensus price targets actually mean anything?

Professional stock analysts do a very thorough job of providing analysis and helpful information about publicly traded companies that they cover. But how accurate are they are their ratings or price targets? Predicting the future – especially in the stock market – is a near impossible task. How can one know with any sort of accuracy what the stock price of a company will be months or years in the future?

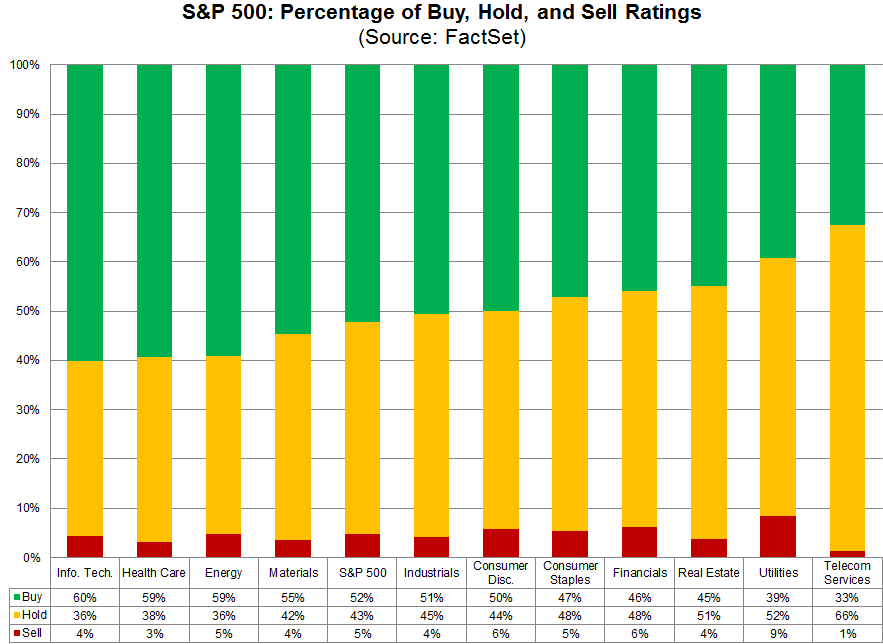

In my experience, analysts’ ratings aren’t a great predictive tool for short-term stock prices or paths (higher or lower). Let’s travel back to March 2018 and look at the breakdown of ratings from analysts. There were 11,094 ratings on stocks in the S&P 500 Index back in March 2018. The math translates to a simple average of 22 unique analyst ratings for each stock in that index. The breakout of those ratings by sector are in the chart below. The overall ratings for companies in the S&P 500 Index included 52% of Buy ratings, 43% of Hold ratings and 5% of Sell ratings. Now, the ratings aren’t on a universal standard – they could be for different time periods or include slightly different qualifying criteria. But generally, they tend to reflect a time period of 6-18 months.

So let’s fast forward from March 2018 to the end of that year. How did stocks in the S&P 500 perform? For 2018, 34% of the S&P 500 stocks were up, and 66% were down. The average change in price for a S&P 500 stock during 2018 was -8.5%. In March, analysts had believed 50% of stocks would go higher and only 5% would go lower, with the balance (45%) being about flat. Not really close at all. This observation is indicative of what I’ve observed over many years.

This doesn’t mean that professional analysts are bad at judging the future prospects of a company and making an educated assessment. But it does demystify the link that their ratings and associated price targets are signals to be blindly followed

Fortunately my relative was working with a financial planner who convinced him sell some of his Company X holdings and diversify. His financial plan and risk tolerance were more important than the false certainty he sought in what ‘they’ were saying about his large stock holding. It also turns out ‘they’ were way off on their rating and price target – the stock never got to $120 and unfortunately declined to around $50 over the subsequent years.