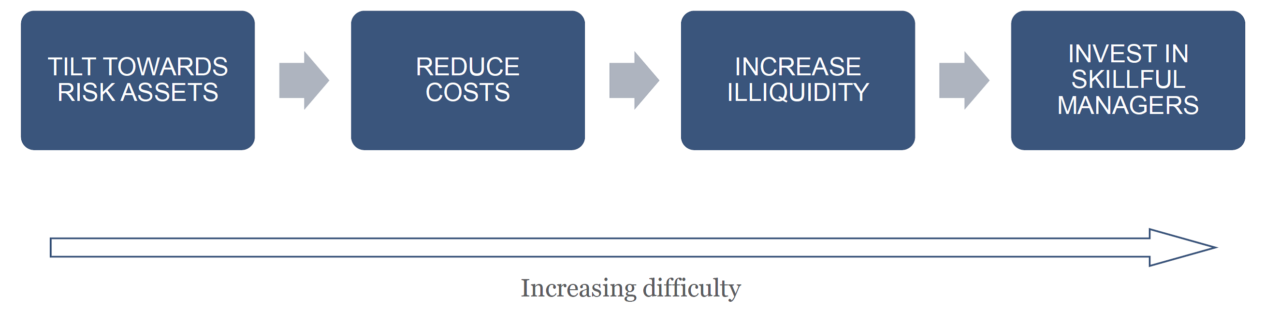

An investor can take four actions to increase expected investment returns over time. As shown in the schematic below, these are, in order of increasing difficulty: (1) tilt the portfolio weighting towards risk assets, (2) reduce costs of the portfolio, (3) take advantage of the liquidity premium, and (4) choose and invest with skillful investment managers (or identify attractive investments). This paper will discuss the opportunities and challenges in increasing investment returns via each of these four strategies.

Tilt Portfolio Towards Risk Assets

Risk and return are related, and the simplest way to increase the potential returns of a portfolio is to take on additional risk.

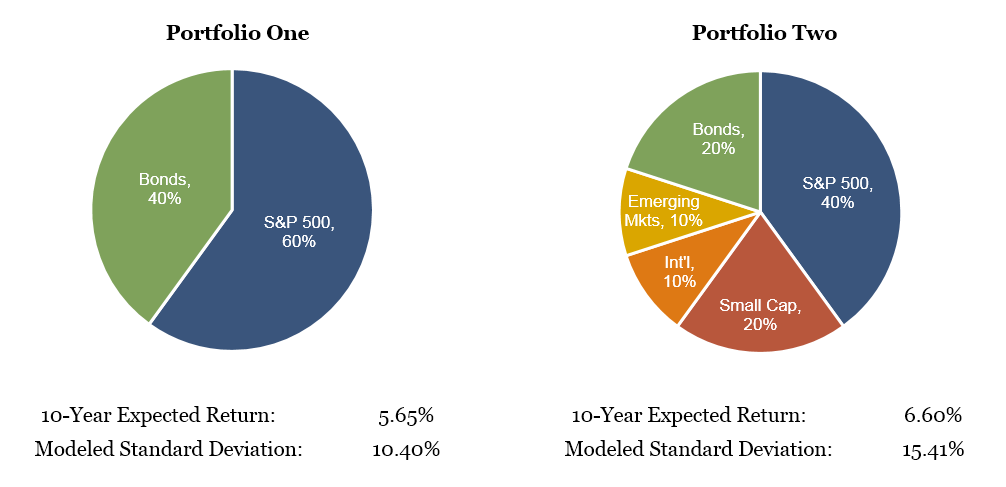

For example, if an investor’s assets are sitting in cash at a bank earning nearly nothing, she can invest in riskier investments than cash such as commercial paper, bonds or stocks, to increase potential returns. Similarly, a portfolio invested in 60% blue chip stocks and 40% high-quality bonds can be altered to potentially generate higher future returns by adding small company, international and emerging market stocks and reducing the allocation to bonds. Below are the expected returns and expected volatility (a measure of risk) of these two portfolios using 2017 capital market assumptions from Callan Associates Inc.:

It is important to note that there are many types of risk, and merely taking on risk does not guarantee higher returns. For example, it may be quite risky to invest in your cousin’s mobile cat washing business when he has no prior business experience, but such a risky investment likely will not yield higher returns. It is prudent to limit or reduce types of risk that do not provide return potential commensurate to the amount of risk being undertaken. Thus, portfolio construction is a balancing act between taking on risk and managing portfolio return expectations.

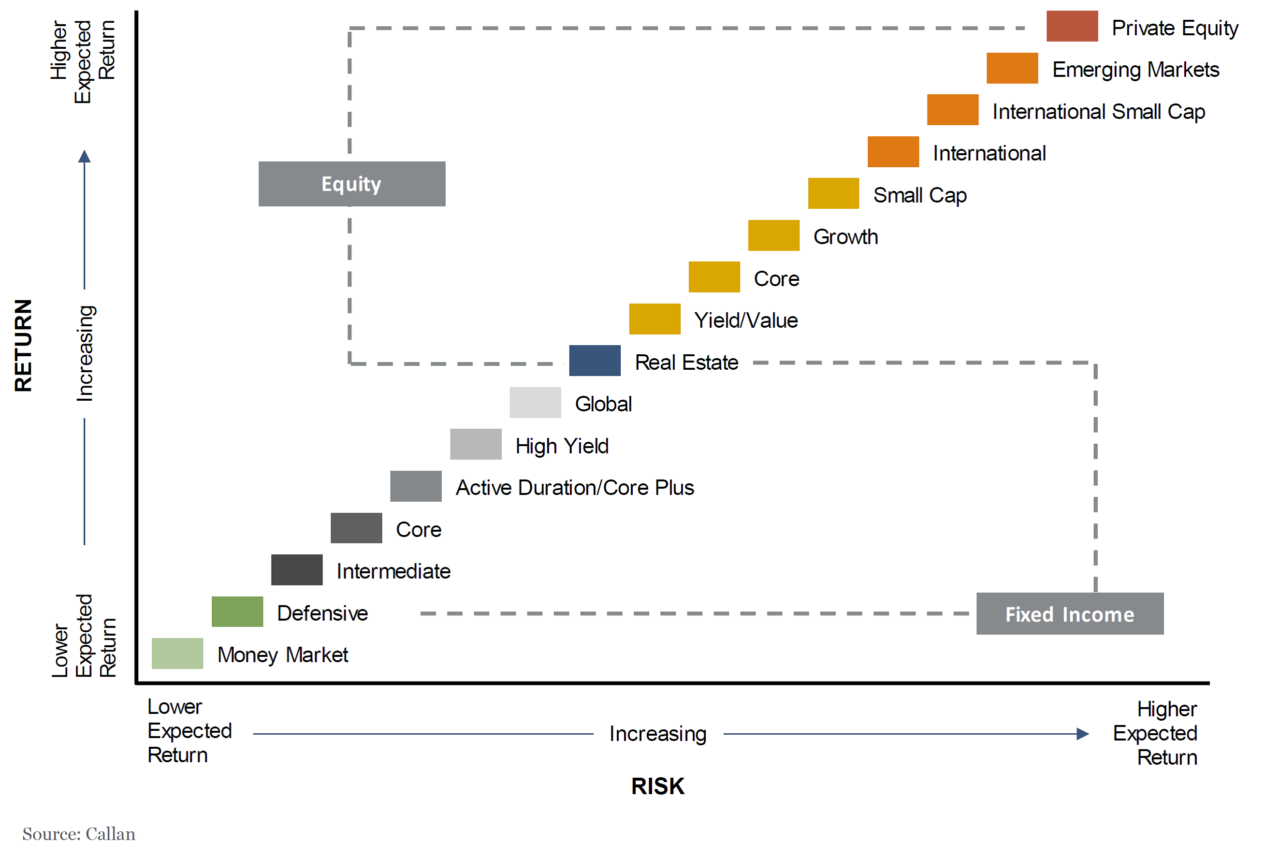

The below chart illustrates, in a very simplified manner, the general trade-off between risk and returns of common asset classes.

Reduce Costs

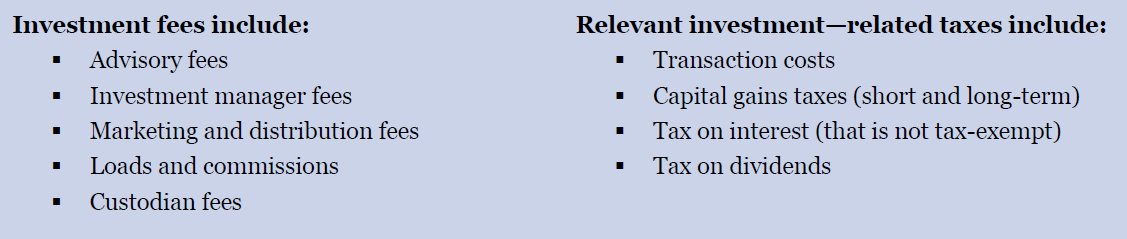

In investing, a penny saved is a penny earned. A less obvious way to increase returns is to realize that only net returns matter and focus on reducing investment costs. The two main categories of investment costs are fees and taxes.

Fees and taxes are a fact of life with investing and cannot be completely eliminated, but both can be managed. Costs should be incurred only when there is likelihood that there will be positive return on the costs incurred. Below are some best practices for reducing investment-related costs.

- Know the fees you are being charged. How much is each investment manager charging? When selecting investments, generally favor those with lower costs.

- Know the expected taxes are on each investment. A pre-tax return that looks appealing might not be as attractive on an after-tax basis. Be wary of investment funds and managers with high portfolio turnover or those that commonly recognize short-term gains.

- Only invest in an active investment more expensive than a passive option when there is a very good reason to do so. That is, where good passive investment options exist, use those costs (fees and tax drag) as the benchmark for evaluating the costs of other investments (see section below about selecting skillful investment managers).

Take Advantage of Liquidity Premium

Illiquid investments tend to earn more than liquid investments over time. This excess return is referred to as the “liquidity premium”. The reasons for the liquidity premium are beyond the scope of this paper, but suffice it to say that investors require compensation for investing in illiquid investments, and thus illiquid investments can be purchased at cheaper prices than a liquid counterpart.

Investors with long time horizons can afford to forego short-term liquidity and look to harvest the liquidity premium. Additionally, at times of market stress, liquidity is in high demand. At those times (think 2008-2009), investors who are willing to trade some of their liquidity for illiquidity are handsomely rewarded.

Taking on illiquidity usually means investing in private assets such as private equity, private real estate and direct business interests.

Select an Investment Manager Who Will Outperform

Identifying in advance an investment manager who will outperform is by far the most difficult of the four strategies for outperformance. A multitude of academic and industry research confirms that only a small portion of investment managers outperform their benchmarks over time, net of fees. Reasons why it is so hard to identify in advance investment managers who will outperform include:

- The Paradox of Skill – Almost every investment manager is educated and skillful. These managers compete against each other and in doing so have ground away most excess returns.

- Information – The internet has leveled the playing field in terms of access to information. Thus, it is difficult to find managers who have access to better information than their competitors.

- Fees and Taxes – Managers who generate outperformance before fees and taxes often underperform once fees and taxes are considered. Thus, in many asset classes, the odds are against you in picking the small minority of managers who outperform net of fees and taxes.

- Business Risk – Even skillful managers with developed and proven investment philosophies and disciplines will underperform for periods of time. During periods of underperformance, asset outflows can lead to the manager’s failure. Likewise, the death, retirement or other turnover of key personnel can also lead to problems for a skillful investment manager. Thus, even if you have identified a skilled manager who likely will outperform after fees and taxes, there may be business reasons for not staying invested in the manager. And, this may happen at exactly the wrong time.

- Lack of Persistence – There is little or no persistence with respect to manager performance. Thus, identifying managers who have outperformed in the past is a dangerous siren song that usually leads to frustration. Instead, the identification of skillful managers is much more nuanced, with factors such as fees, philosophy, discipline, portfolio turnover and the like playing a much more significant role than past returns.

Similar to identifying investment managers who will outperform, identifying attractive individual stocks or investments that will outperform requires access to better information or having superior analytical abilities, both of which are difficult in the very competitive modern investment environment.

While the challenges described above make it difficult to identify in advance investments and managers that will outperform, it is not impossible. It simply must be approached in the best manner to increase the chance of success. Discussion of how to outperform the markets by selecting investments or managers who will outperform is the topic of a related paper entitled “How to Outperform the Market” which will be released soon.

Conclusion

A prudent way to design an investment portfolio is to consider the four strategies discussed above. Given the difficulty of finding, in advance, investment managers who will outperform, long-term success often requires incorporating the other three strategies in combination with investment manager selection.