Just hearing the words “opportunity zone” seems to draw the attention of novice and professional investors alike. The combination of the term “opportunity” coupled with the most frequent words people hear next, “incredible tax benefits,” makes opportunity zones seem like a worthy investment to investigate. Who wouldn’t want to invest in something described in such an attractive manner? Not so fast… In this article we’ll offer a brief overview of opportunity zones as well as provide a few guidelines to help determine if investing in Qualified Opportunity Funds is appropriate for you.

What We Know

The Tax Cuts and Jobs Act of 2017 created over 8,500 Qualified Opportunity Zones (“Opportunity Zones”) across all 50 U.S. states, Washington DC and Puerto Rico. The purpose of these zones is to attract long-term investment into low-income, economically-distressed communities. The only allowable investment vehicles in Opportunity Zones are Qualified Opportunity Funds (“QOFs”), which can invest in real estate located in Opportunity Zones or businesses operating in Opportunity Zones. The investment community has quickly focused its attention on the real estate opportunities which are easier to identify and have broader appeal to retail investors than private business investment opportunities. As such, virtually all current investment opportunities presented to investors are real estate focused (the importance of this fact will be addressed in detail later).

While the potential to reinvigorate economically challenged communities is exciting, the real draw for most investors is the potential tax benefits. These benefits can be broken down into the following categories:

- Capital gain deferral: Realized capital gains that are reinvested in a QOF within 180 days can be deferred from taxable income until the earlier of December 31, 2026 or the date the QOF is sold.

- Partial capital gain forgiveness: An investor can exclude up to 10% of the original realized gain if the QOF is held for five years and up to 15% of the original gain if the QOF is held for seven years.

- Capital gain exemption on appreciation of a QOF: If the holding period of the taxpayer’s QOF is 10 years or more when the investment is sold, any appreciation on the investment is exempt from taxes.

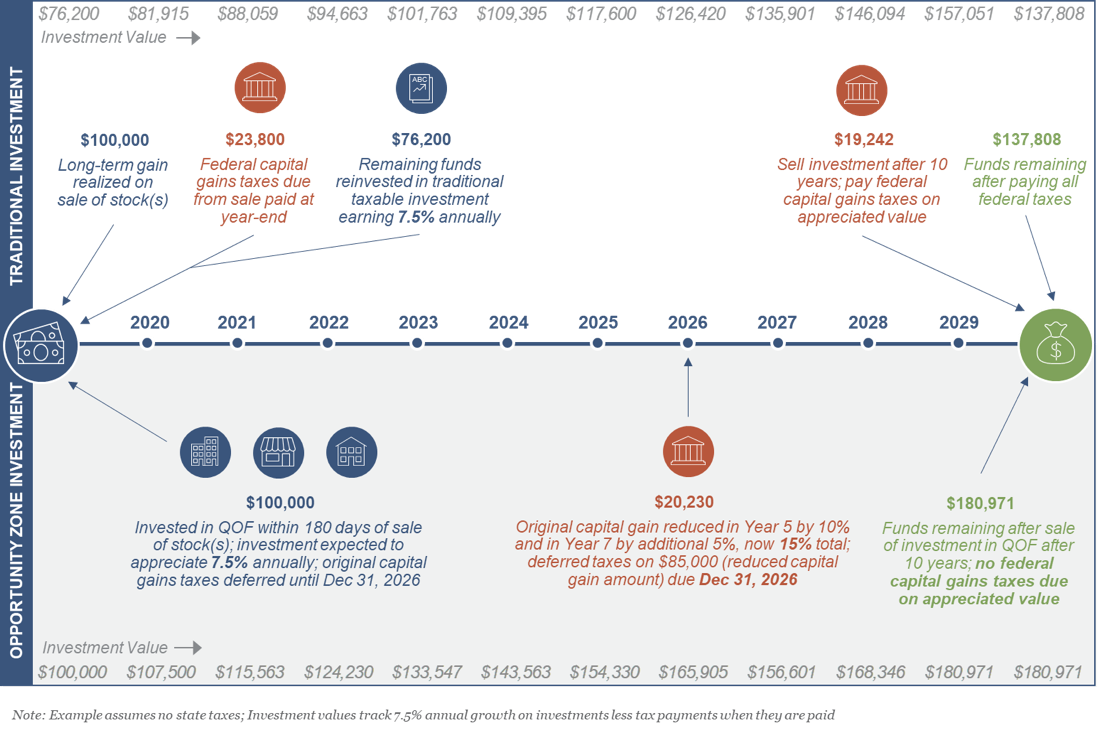

In plain English, there are two major tax benefits associated with investing in a QOF: (1) a tax deferral and a 10%-15% tax exclusion relating to the capital gains rolled into the QOF, and (2) potentially paying no taxes on the actual QOF investment if sold after ten years. Basically, investing capital gains realized from a sale of any property (including stocks and bonds) into a QOF provides the first aforementioned benefit of tax deferral. Associated with that benefit is a 10% reduction in those original capital gains if an investor holds the QOF for at least five years, and an additional 5% reduction if held for seven years. The deferral of these taxes lasts until December 31, 2026 at which time an investor will have to pay taxes on the original capital gains (which may have been reduced by 10 or 15%) at the current applicable tax rate. These taxes will be due even if an investor continues to hold the QOF past the end of 2026. The second major tax benefit is the total abatement of federal capital gains taxes on a successful investment in a QOF that is sold after ten years.

The following illustration attempts to demonstrate the tax benefits of investing in a QOF. The example follows the cash flows after an investor realizes a $100,000 capital gain and chooses to reinvest the gains in either a traditional investment or a QOF and then ultimately liquidates the investment after ten years.

Opportunity Zone Investor Cash Flow Example

As you can see above, the two investment options have the exact same annual rate of return (7.5%) but the QOF generates almost $43,000 of additional sales proceeds after ten years due to the preferential tax treatment. The potential magnitude of these tax benefits is the reason so many investors are clamoring for more information about Opportunity Zone investment opportunities. Surprisingly, there hasn’t been much press about the final benefit – the permanent tax exemption for gains on the sale of QOFs after ten years – which has the potential to far exceed the other two benefits if the underlying investment is successful. There are very few opportunities for investment gains to be tax exempt. One such instance is qualified withdrawals from 529 plans, which are tax exempt but must be used for qualified education expenses. Another instance is withdrawals from ROTH IRA accounts, which are tax exempt but can only be established by qualified investors. The ability to invest and have all appreciation exempt from taxes cannot be understated. The real challenge is finding a successful investment that will appreciate over ten years.

Does Investing in a Qualified Opportunity Fund Make Sense for You?

“Don’t let the tax tail wag the economic dog.” This rather odd proverb simply refers to the importance of prioritizing a good investment decision over the tax consequences associated with that decision. In other words, don’t let the potential tax benefits/costs blur the viability of the underlying investment decision. Similarly, the decision to invest in a QOF should be based predominantly on the merit of the investment and how it fits into your financial strategy, not on the tax benefits, which we would think of as “icing on the cake” if the underlying investment is successful. The annals of investment lore are riddled with failed investments which investors entered into based on tax benefits. For example, if you reduce the investment performance of the QOF by 35% in the illustration above, the traditional investment is more valuable after 10 years, even with the amazing tax benefits of the QOFs.

The Opportunity Zone program is not a secret. All current property owners in Opportunity Zones know about the tax benefits associated with the development or redevelopment of their properties and are likely increasing their asking prices accordingly. This creates a double-edged sword; to maximize the tax benefits associated with Opportunity Zone investments, investors must act quickly. Yet Opportunity Zone property prices have nearly reached their zenith and investing now forces a developer to stretch the budget even before the actual development/redevelopment of the property has begun. Not to mention, real estate in low-income, economically-distressed communities is, by nature, more risky than real estate located in stable economic communities. These factors collectively highlight the importance of choosing an investment based on the merits of the actual investment rather than solely considering the value of the potential tax benefits.

Additionally, timing for making these types of private investments is important. Like all investments, future returns are dependent on where we stand in the economic cycle. Unless you systematically invest capital gains into these funds, you are essentially timing the market, which is somewhat like betting that it will rain more this year than in any year in the next decade (for clarification on this analogy, search “vintage year diversification” on Google).

So, does investing in QOFs make sense for you? Let’s recap: (1) there are very powerful tax advantages associated with QOFs, (2) uncertainty remains on select rules and regulations surrounding the QOFs and (3) evaluating the quality of the investment opportunity is essential. Now figure in the fact that currently most QOFs are real estate-focused (i.e. no sector diversification) and that the investment vehicles are illiquid (unlike ETFs or mutual funds which have daily liquidity). The potential for high returns remains, but there is an increased potential for high risk.

For these reasons, investors need to spend considerable time determining the suitability of a concentrated, illiquid real estate investment in the context of their overall investment portfolio strategy. Most often, the capital gains which investors would use to invest in QOFs are sourced from liquid and non-sector specific investments. Immediately redeploying these gains to defer taxes may be short-sighted because it would likely change the risk profile of the investor’s overall portfolio. Given this set of facts, we think QOFs are fantastic investment vehicles for veteran real estate investors who understand the risks associated with real estate investing and whose existing portfolio allocations account for private real estate. We think the rest of the investment community should think twice before leaping into this new pool of investments, despite the intriguing name and the tax benefits.

Final Thoughts

We are capitalists and understand the potential financial rewards associated with QOFs. However, the purpose of the Opportunity Zone program is to help spur economic activity and development in struggling communities. There is no doubt that the current QOFs will improve these communities, but as this space matures, investment programs with more clearly defined social impact goals and reporting requirements will come to market and, as a result, the original intent of the Opportunity Zone program will be more fully realized.