In Berkshire Hathaway’s 2013 Shareholder Letter Warren Buffett famously noted that his last will and testament requires trust assets for his wife’s benefit to be invested as follows: 10% in short-term governments bonds and the remaining 90% in a very low-cost S&P 500 Index fund. Buffett’s mandated portfolio notably excludes assets such as U.S. small cap stocks, international stocks, corporate bonds, municipal bonds and other investments commonly held in contemporary institutional and individual investors’ portfolios. Buffett’s statement leaves many investors asking, “is it really that easy?” and “why do I have all this other stuff that Warren Buffett says I do not need?” We think these are fair questions which warrant some additional discussion.

To start with, there is no one right way to invest. Everyone’s goals are different, and there are usually several ways to invest to achieve them. As professional investors, we strive to invest in a manner that accomplishes our clients’ goals while minimizing their risk of loss. Warren Buffet’s simple 90% S&P 500 Index and 10% bond portfolio (“90/10”) is suitable for some investors. However, a 90/10 portfolio is a relatively volatile one, and many investors may benefit from establishing a portfolio with lower volatility.

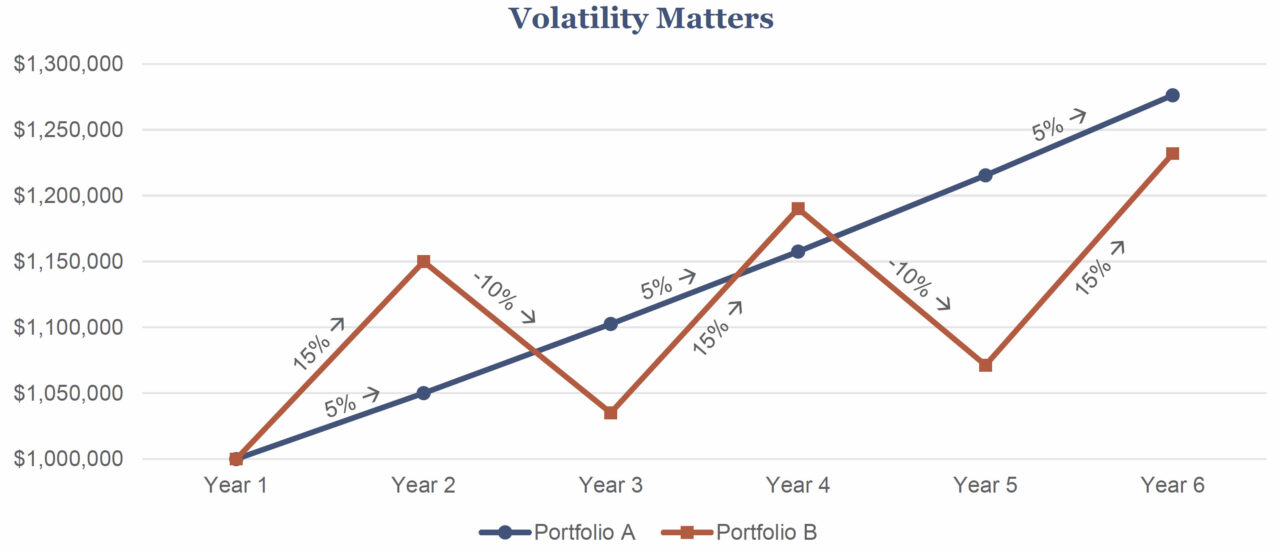

Creating an investment portfolio that reduces volatility is beneficial from both return and psychological perspectives. Wait – how does reducing a portfolio’s volatility increase its overall return? Interestingly, a smooth stream of returns will produce more dollars over time than a volatile stream of returns with the same average arithmetic return. The math is demonstrated on the chart below – two $1 million portfolios averaged a 5% annualized return over five years, but the volatility experienced in Portfolio B reduced its five-year total return by over $40,000 in comparison to Portfolio A.

Reducing volatility is also beneficial from a psychological perspective. Humans are emotional creatures, and reducing volatility helps moderate fear, greed and other emotions that can lead to poor decisions. Given these psychological challenges and the mathematical benefits of reducing volatility, we (along with most professional investors) believe the best option is portfolio diversification.

There are many ways to diversify an investment portfolio. One popular diversification technique focuses on the number of investments within a portfolio. While owning one stock and one bond could technically be considered a diversified portfolio, we recommend a portfolio that includes multiples stocks and bonds. Having numerous holdings prevents a single stock or bond from sinking the entire ship.

Buffett’s equity strategy is sufficiently diversified to eliminate single stock risk, but his choice of investment vehicles – a S&P 500 Index fund which invests in large cap U.S. companies – provides neither exposure to smaller companies nor any significant international diversification. While the large cap U.S. stock market may, at times, outperform the other equity markets, it will also underperform during other times. These cycles can last for a decade or more and cannot be predicted consistently. A particularly long cycle could lead to second guessing one’s investment strategy and ultimately, to costly decisions to sell and/or buy at inopportune times.

So, is Warren Buffett wrong? The simple answer is no. There are many ways to invest that can achieve desired goals. If you were to invest as Buffett recommends and stick with it for several decades, the results would probably be good. However, most people cannot maintain Buffett’s discipline when the strategy – which is primarily concentrated in one asset class – experiences prolonged periods of both relative underperformance and negative performance, which it inevitably would (and has in the past). This uneven performance would likely cause many investors to waver and change strategies.

Our personal and professional experience tells us that most people will achieve better results by diversifying more broadly than Buffett recommends. By adding other assets such as small cap and international stocks, investors can reduce volatility and create a smoother return pattern. We recognize that a well-diversified, all-weather portfolio will never outperform a hot market in the short-term, but reducing volatility will help investors stick with a strategy over the long-term, which allows dollars to compound and goals to be achieved.