Let’s be honest, private air travel is a luxury that most everyone would enjoy. Given the opportunity, who wouldn’t want to avoid long security lines, lengthy layovers, inflexible travel times, lost luggage, cramped seats and unpleasant co-passengers? Eliminating these factors undoubtedly results in a less stressful and much more convenient travel experience. If you’re fortunate enough to consider leaving commercial air travel behind for the bluer skies of flying private, there are multiple options available to you, including buying a plane, buying a portion of a plane or chartering someone else’s plane. This article will help you better understand the benefits, costs and risks of each alternative before deciding which option is best for you.

Summary of Flying Private Options

Outright Ownership

Outright ownership of an aircraft is what most people envision when thinking about flying private. The plane is your plane just like your car is your car. You pick the type, size and age of the aircraft and customize the exterior and interior of the plane to your preferences. The plane is available to you whenever and wherever you need it. Weekend trip to Napa? No problem. Dinner in Miami? No problem. The plane will always be where you are and ready to go at a moment’s notice.

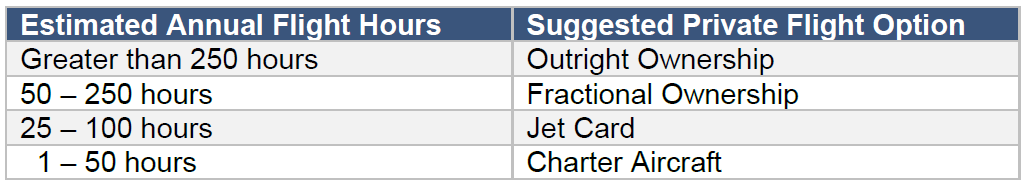

Yet, despite the incredible convenience and flexibility of outright ownership, it requires abundant financial resources. In addition to the initial cost of purchasing the aircraft, there are ongoing expenses to hangar, operate and maintain the plane as well as costs to hire and train the pilot and crew. Regular inspections of the aircraft are required, which can be costly and may take the plane offline for significant periods of time. Some aircraft owners opt to hire a company to manage the plane and may even allow the company to charter the aircraft during down time to help offset the cost of private ownership. A general rule of thumb is that outright ownership makes sense for individuals who will fly more than 250 hours per year.

Fractional Ownership

You may consider fractional ownership if you fly between 50 and 250 hours per year and/or don’t want the burden and costs associated with owning a plane outright. As the name implies, fractional ownership involves purchasing part of an aircraft and sharing the costs of ownership (i.e. maintenance, insurance and other operating expenses) with others. In this situation, you enjoy all the comforts of flying private as described above; however, you lose some of the flexibility that comes with outright ownership. For example, unlike outright ownership, a fractional interest requires advanced planning and booking to ensure the plane is available (i.e. not in use by the other owners). Additionally, with only a fractional interest, you do not have the opportunity to customize the aircraft to your personal tastes and preferences.

While fractional ownership can be accomplished by identifying and working directly with other private individuals, a cottage industry has developed to bring fractional owners together to manage aircrafts. These companies house the planes, maintain them, provide the pilots and crew and often charter the planes to non-owners when not in use. One significant advantage is that the operators typically offer the option to upgrade or downgrade the type of aircraft to meet your needs for a particular trip.

Fractional ownership is often sold in 1/16 share increments, each of which generally give the owner the ability to fly 50 hours per year. Ownership of the plane usually lasts for five years, at which time you may be able to sell your ownership interest to recover a portion of the upfront costs. The actual costs, which are based on usage, vary from program to program and can include an hourly flight charge, fuel surcharges, landing fees, pilot expenses and other miscellaneous charges. It is important to carefully review the terms of the ownership agreement to understand potential charges involved.

Jet Cards

For individuals who fly between 25 and 100 hours per year, jet cards or jet memberships offer another avenue for private air travel without the commitment of outright or fractional ownership. Again, you enjoy the perks of flying private but with less convenience than the other options. There are numerous jet card providers and the terms can vary widely.

Jet card programs typically involve an initial purchase of flight hours or a specified pre-paid dollar amount for the contract term. The hourly cost of travel is then locked in for the term of the contract. Operators will normally require a minimum amount of notice for booking travel and may charge additional fees for fuel, one-way trips, landing fees, de-icing fees, pilot expenses or other charges. The program may specify peak travel days throughout the year, which require additional notice and may involve an upcharge for use of an aircraft. Based on recent analysis for one of our clients, the all-in costs for use of a mid-sized jet through a jet card program ranged from $5,800 to $10,200 per flight hour.

When choosing a jet card provider, it is important that you consider the size and age of aircrafts in the program, the safety rating of the operator, and the experience of pilots who fly for the operator. The longevity and financial stability of the provider is another key consideration. There are industry consultants who can help you navigate these complexities for a fee. As with fractional ownership, it is important to carefully review the contract to understand the terms and potential charges prior to buying in to the program.

Direct Charter

If you don’t want the initial financial outlay of a jet card or airplane ownership, you can always book charter flights directly with local operators. The cost per flight hour can be significantly less than either fractional ownership or a jet card; however, direct charters often provide far less convenience and reliability than a more structured program. Booking could require calls to multiple operators and negotiation of costs and fees each time you fly. Often, there are additional charges for pilots and crew, repositioning the aircraft, one-way trips, fuel and other fees. Availability of aircraft is not guaranteed and booking a flight around peak travel days could be difficult. As with jet cards, it is important to understand the age and size of the aircraft being offered, the safety rating of the operator and pilot qualifications when using direct charter.

Conclusion

Flying private is a true luxury that saves time and provides unmatched comfort. As discussed above, there are many options available and it can be difficult to sort through and understand the differences. While financial considerations are important and significant, often the decision comes down to which alternative affords the most convenience and peace of mind when traveling.