Background on the European Union

The European Union (EU) is an economic and political union of 28 countries (soon to be 27). It originated out of a movement to create unity between Germany and France following World War II in an effort to foster economic cooperation – the idea being that countries that trade with one another become economically interdependent and thus more likely avoid conflict. It began with six countries and has grown over the decades.

The population of the EU is over 500 million people, and its GDP is $18 trillion. Comparatively, the United States has 330 million people and a similarly-sized GDP. The 28 countries within the European Union are Austria, Belgium, Bulgaria, Croatia, The Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom (England, Wales, Scotland, and Northern Ireland).

Each of the 28 countries in the EU are independent but agree to free trade within the union. In addition, they agree to the open movement of people regardless of citizenship – there are few or no border controls among EU countries.

Of the 28 countries in the EU, 19 of them use the Euro as their common currency. Those 19 countries are referred to as the “Eurozone.” The UK is not part of the Eurozone and has maintained the British Pound as its currency.

What Happened?

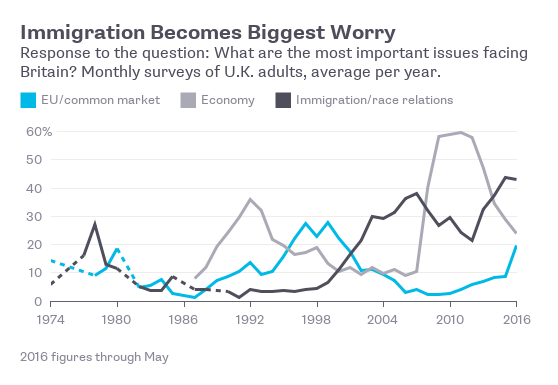

Due to mounting political pressure, a referendum was called in the United Kingdom to vote on remaining in the EU or exiting the union (“Brexit”). That vote occurred yesterday, June 23rd, with a vote to Leave of 52% and Remain of 48%. Concern about immigration was a driving force behind the Leave vote as many Brits were concerned about the economics and effect on national identity as the result of 330,000 immigrants entering the UK in 2015. With Turkey potentially becoming an EU country in the next few years, many Brits were concerned about the 77 million mostly Muslim Turks being able to freely enter the UK. Other concerns included the costs associated with being a part of the EU and its bureaucracy, as well as concerns about UK sovereignty.

The vote to Leave surprised the markets – the global equity markets and British Pound experienced strong performance yesterday in anticipation of Remain winning. However, as it became clear that Leave was going to win the referendum, the British Pound dropped more than 10% overnight, and global equity market futures dropped. The yield on the 10-year US Treasury fell to 1.5% – nearly as low as the depths of the 2008 financial crisis – as money flows into relatively safe assets. Volatility in risky assets has spiked, and the price of gold has jumped.

What Are the Potential Ramifications of Brexit?

There will certainly be an economic impact, although the specific ramifications and degree of severity remain unknown. The treaties and trade agreements among the UK and the remaining EU countries are tremendously complex. Exactly how the UK will extract itself from the EU is not known, and negotiations are expected to take at minimum of two years. What we do know is that the decision to leave the EU creates uncertainty in one of the largest economic areas of the world, and markets do not like uncertainty. We can therefore expect volatility in the equity, currency and fixed income markets for the foreseeable future as the Brexit is digested.

Brexit is likely to have a material negative impact on the UK. For one, the UK’s departure will likely weaken London’s current standing as a global financial hub. In addition, the other EU countries constitute the majority of the UK’s trading partners, and trade among UK and the EU will be restricted going forward. Thus, their domestic companies will be harmed, resulting in slower economic growth for the UK overall.

There is also concern about the political ramifications and contagion from this decision. The British Prime Minister, David Cameron, is expected to resign, as he was pushing for the Remain vote. Scotland may call for another referendum to vote on exiting the UK (a measure that failed not too long ago). And will other EU countries similarly call for referendums to exit the EU in light of the UK’s departure?

Ultimately, emotions and nationalism won out over economic arguments, showing that voters may not fully appreciate or feel a benefit from globalization. We are seeing a rift between those who have benefited from globalization and the rest who have not. Nationalist and populist movements have been gaining traction in many developed countries over the past decade. Growth across the developed world has been slowing, especially in the wake of the 2008 financial crisis, and economic inequality has risen to levels not seen since the 1920s. Lack of wage growth, rising debt, and stagnated standards of living have put globalization under pressure as free trade and immigration are seen by working class citizens as threats. Similar sentiments have been displayed throughout the presidential election primary process in the United States.

As Investors, What Should We Do?

First and foremost, it is important not to make rash, emotional decisions during times of market volatility. Financial markets generally price in expectations of the future. The more uncertain the future outlook becomes, the more volatility we would expect to see in asset prices.

The effects of Brexit over the short or long term are not known. A major country has never exited the EU (Greenland and Algeria are the only countries to exit previously and under different EU arrangements). Some economists are forecasting doom for the UK and Europe as a result of Brexit, while others say that predictions of disaster are overblown, and that when the dust settles, this will not be a big deal. Whether this is a good time to reduce allocations to international stocks or a great buying opportunity for international stocks is not knowable at this time.

Our advice is to sit tight with your current allocations – investment strategy changes made in the midst of uncertainty and volatility are rarely good decisions. Over the past 30 years we have experienced many surprises and uncertainty-creating events such as the Savings and Loan Crisis, the fall of the Soviet Union, the first Iraq War, Asian financial crisis, Russian bond crisis, blow up of Long-Term Capital Management, the Dot-Com bubble and burst, September 11th, the war(s) against terror, the housing bubble, the Great Recession, the debt ceiling debacle, the downgrade of US Treasuries, and the European Debt Crisis. Over that time period, attempts to get and out of the risk assets would be ineffective and costly.

Over the coming months we will have further information, and we will discuss with each of our clients whether changes to their portfolios are advisable in light of Brexit and the surrounding events.

In the meantime, please contact us with any questions or concerns.