The Gist of the Debt Ceiling Issue

Enacted during World War I, the “debt ceiling” is the cap on how much the US government can borrow to meet its legal obligations. Because the US government runs a deficit yearly, the debt ceiling must be raised periodically, or the government will default on its obligations – meaning it can’t pay things like interest on Treasury bonds, Social Security and Medicare payments, and paychecks to government employees and the military.

The debt ceiling is typically raised without much fanfare – it’s been raised 78 times since 1960: 49 times under Republican presidents and 29 times under Democratic presidents. But periodically, when Republicans control a chamber of Congress while there is a Democrat in the White House (as is the case now), Congress plays a game of chicken where it says it won’t raise the debt ceiling unless specific demands are met (typically spending cuts). This happened in 1995, 2011, and 2013.

The idea that the debt ceiling might not be raised, causing the US government to default on its obligations, is unthinkable as full faith and credit of the US government is held as sacrosanct. The closest the government has come to default was in 2011 when it was only days away from disaster. The ceiling was raised before default when President Obama and Congress agreed to spending cuts along with the debt ceiling increase. But pushing the debt ceiling fight to the brink caused considerable turmoil in the financial markets (the Dow dropped 2,000 points) and resulted in S&P downgrading the credit rating of US Treasuries.

The Republican-controlled House and the White House will most likely agree to raise the debt ceiling. But then again, maybe they won’t, as the US political landscape is fraught with division and lack of compromise.

The financial and economic toll that will occur if the government defaults is unknown – it hasn’t ever happened. But we know it won’t be good. Even getting close to a default likely will have significant consequences, as was the case in 2011.

How should investors think about this – what should we do? Let’s first take a step back and consider a hypothetical.

What History Teaches About How to Behave in the Face of Uncertainty

Imagine you woke up on January 1, 1990, and found that overnight you had been gifted a crystal ball that told you of significant events that would occur over the next 32 years:

- 1991 – The US will enter a recession, go to war in the Gulf, and the Soviet Union collapses.

- 1993 – The World Trade Center will be bombed, the first of a trio of previously unimaginable acts of terrorism on US soil.

- 1995 — The federal building in Oklahoma City will be bombed, the second major terrorist attack, killing 168.

- 1995-1996 – The government will shut down for nearly a month because the Republican-controlled Congress and the Clinton White House can’t agree on a federal budget. Disagreements over the budget will lead to an impasse between Congress and the White House about raising the debt ceiling.

- 2000 — Spurred on by a craze for “dotcom stocks,” the stock market will become a speculative bubble and then burst, resulting in a 49% decline, with the tech-heavy NASDAQ falling 77%.

- 2001 — A third terrorist attack will occur on September 11th, killing nearly 3,000 people, forever changing the fabric of American life. The US enters recession.

- 2001 – 2022 — In response to 9/11, the US will engage in the “War on Terror,” leading to 900,000 deaths and costing the US $8 trillion.

- 2008 – 2009 – A financial crisis will rock economies across the globe. The US stock market falls 57% from peak to trough, and the US suffers the worst recession since the Great Depression. The global financial system nearly collapses.

- 2009 – 2014 – Multiple European governments will nearly fail. Known as the European Sovereign Debt Crisis, this crisis will have far-ranging global economic effects.

- 2011 – Another debt-ceiling stand-off will occur. The borrowing limit will be raised at the 11th hour, but not before causing tremors across the financial markets and leading to S&P downgrading US Treasuries.

- 2013 – Yet another debt-ceiling crisis, but this one will be resolved more quickly than in 2011.

- 2020 – A global pandemic, the likes of which the world hasn’t seen since the Spanish Flu in 1918, will begin, killing 336,000 Americans that year and over 6 million globally over the next three years. US GDP will fall by 8.9% in a single quarter, and unemployment will spike to 14.7% (the highest recorded since the Great Depression).

- 2021 — US presidential election will be contested. The peaceful transfer of power is imperiled as rioters storm the US Capital to overthrow the election.

- 2022 – Russia will invade Ukraine, putting geopolitical tensions on red alert.

Imagine how you’d feel when presented with this list of bad events. At the time, without knowing how it would turn out, being informed of these future events would probably make you want to bury your money in your backyard.

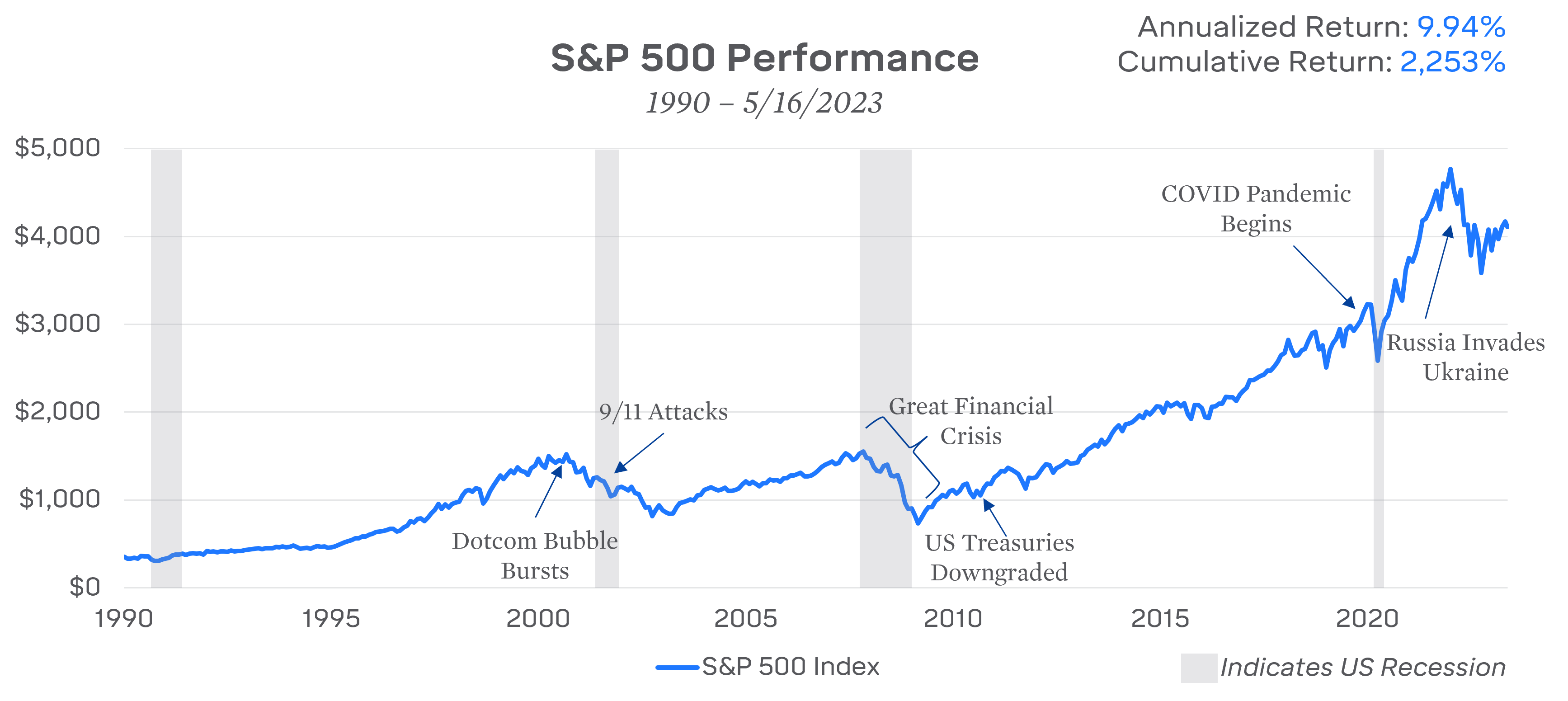

But how did the stock market do during these 32 years? Over the short term, the above events created volatility, stock market losses, and the occasional bear market. But over the long term, being a stock investor during those 32 years turned out great. Since 1990, the S&P 500 has produced a cumulative return of 2,253% — meaning $1,000 invested in 1990 is worth $22,530 now.

ST. LOUIS TRUST & FAMILY OFFICE | DATA FROM FACTSET

Anybody who lived through all these events knows that staying invested has been challenging. But after each traumatic event, the market rebounded and climbed to new heights, as it likely will in the future.

What Investors Should (and Shouldn’t Do) as the Debt Ceiling Fight Continues

There’s much uncertainty about whether the debt ceiling will be raised in time. As we get closer to the government defaulting, we can expect volatility in the stock and bond markets. If default occurs, the economic effects likely will be far-ranging, and the stock market will decline (maybe significantly). But probably, the crisis will be averted, and the stock market and economy will continue without the debt ceiling being a worry for a few years. We just don’t know. For now, we are all mired in uncertainty, and as I wrote in my book, The Uncertainty Solution: How to Invest with Confidence in the Face of the Unknown, humans hate uncertainty. It makes us anxious and worried and causes us to want to act even though inactivity is usually the best investment course of action when faced with uncertainty.

In the face of uncertainty about the debt ceiling:

- You should ensure your portfolio can weather market volatility. At our firm, we suggest having at least a year of planned portfolio withdrawals in cash (or cash equivalents like money market mutual funds).

- You should adopt a long-term perspective. Many bad things will happen over the coming decades (maybe a US default will be one of them), and regardless of these bad events, the stock market will likely provide handsome returns over time. Think of the “what if you had a crystal ball in 1990” hypothetical. Many bad events happened, and the stock market has gained 2,253% since then.

And there are things you shouldn’t do:

- You shouldn’t change your portfolio by betting on what you think will happen with the debt ceiling. You don’t know. Pundits don’t know.

- You shouldn’t panic. This, too, shall pass. As long as you have sufficient cash, resist the urge to act. This is easier to do if you avoid looking at your portfolio during times of volatility.