A question we are often asked by individuals looking to create a pool of charitable assets is whether they should establish a private foundation or a donor-advised fund. As with many of life’s big questions, it depends.

Private foundations (PFs) and donor-advised funds (DAFs) are similar. As with direct giving, they can both provide a tax deduction to offset a big income tax year following the sale of, for instance, a business, investment assets, or real estate.

And they can both provide some benefits that direct giving does not, namely:

- Tax-free growth of assets earmarked for charity and accumulation for strategic deployment.

- Involvement of other family members, including younger generations, in decisions about giving.

- A legacy of charitable giving long after death.

PFs and DAFs – Some Basics

A PF is a non-profit entity created by the donor structured as either a trust or a corporation. The trustees or board (depending on the structure) oversee the foundation’s administration, manage the investments, and make charitable grant decisions.

A DAF is an account at a public charity, commonly a community foundation or the charitable arm of a large financial institution such as Schwab or Fidelity. You can think of a DAF as a pre-packaged PF or a “PF-lite,” where the DAF sponsor handles most of the administration. The donor retains the ability to direct the investment of the funds in their account and to recommend charitable grants that they would like the sponsor to make.

Governance can be structured similarly with family members as trustees or directors of the PF or named account holders of the DAF.

Key Differences Between DAFs and PFs

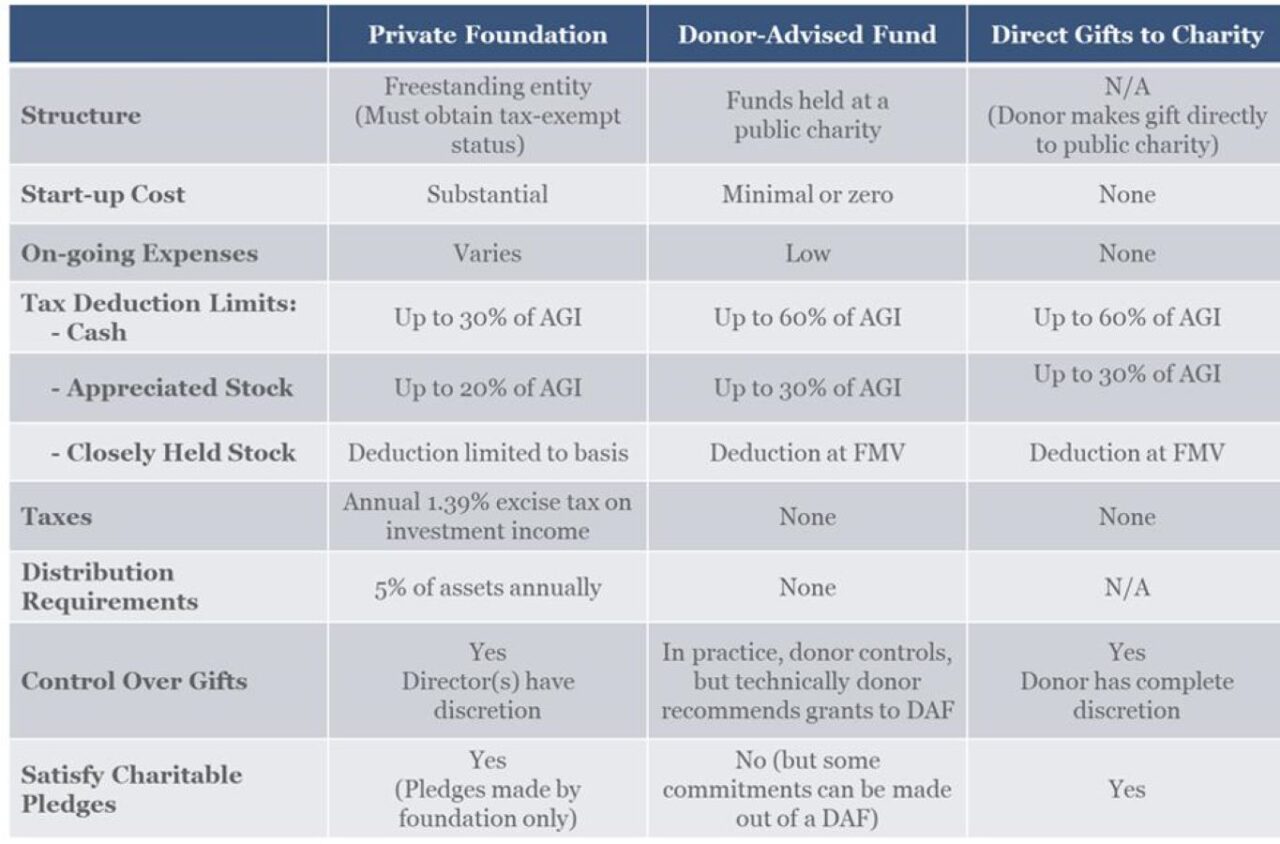

While they are similar in many respects, PFs and DAFs have significant differences that impact which is the best option.

Privacy

A PF must file a tax return with the IRS, which is open to public inspection. With a few clicks, anyone can see the trustees or directors, the value of the assets, and the charities to which the PF has donated. A DAF, on the other hand, is private.

Required distributions

PFs must distribute at least 5% of assets annually to charity. There are currently no minimum annual distribution requirements for DAFs.

Investments

The trustees or directors of a PF control its investments. Subject to their fiduciary duties and restrictions in the tax code relating to investing in private businesses or making concentrated high-risk investments, the trustees can invest however they want.

Investment options for DAFs vary widely depending on the sponsor’s policies and platform. Some DAF sponsors require the donor to use the investments on their platform, as with a 401(k) plan. Other DAFs allow the donor to retain their own investment advisor to manage the assets. Given the wide variation in investment flexibility among DAFs, a donor looking to establish one should shop around and find what works best for them.

Deduction limitations

The income tax-deductibility of charitable contributions is limited to a percentage of a donor’s adjusted gross income (AGI). Amounts exceeding the AGI limit can be carried over and deducted for up to five years. For contributions to public charities, including DAFs, the AGI limit is 60% for cash contributions and 30% for appreciated assets. The AGI limits for PFs are 30% for cash and 20% for appreciated assets.

Contributions of Non-Marketable Assets

Contributions of appreciated assets that the donor has held for more than a year receive a charitable income tax deduction at fair market value (FMV). That allows them to avoid embedded capital gains in the gifted assets.

But there is an important exception to the fair market value deduction rule for PFs; contributions of non-marketable assets such as shares in a closely held business, artwork, or real estate only receive a deduction equal to the cost basis of the contributed assets. So, if you want to gift these, you should use a DAF.

Expenses

It costs little to nothing to set up a DAF. The ongoing expenses are primarily the assets under management (AUM) fee charged by the DAF sponsor, which varies by sponsor and account size.

The cost of establishing a PF can run to tens of thousands of dollars because of the need to create a non-profit entity and apply to the IRS for tax-exempt status. Ongoing expenses of a PF include administration and filing annual tax returns. For simple PFs, these costs are minor, but for larger and more complex foundations, they can be substantial.

Excise Tax

With rare exception DAFs and PFs are free from income taxes. PFs are subject to an excise tax of 1.39% on their net investment income. The PF excise tax is a small percentage but adds to the expense of a PF compared to a DAF.

Control over charitable grants

The trustees or directors of a PF have complete control over charitable grants.

DAFs are different. Technically, DAF donors recommend charitable grants to the DAF sponsor who controls the making of distributions. Practically speaking, however, the donor has control. So long as the intended recipient is a 501(c)(3) charity and meets other basic requirements common to both PFs and DAFs, the sponsor will rubber-stamp the request.

Ability to make charitable pledges

Neither PFs nor DAFs can satisfy pledges made by individuals. So pledges must be made by the PF or DAF, not by the donor or other individual.

There is no barrier to PFs making pledges. DAFs, however, cannot make binding pledges. But they can usually make non-binding commitments, which typically satisfy the grantee charity.

So, Which Should You Use?

Which vehicle is right for you will depend on your particular circumstances and how you weigh the importance of the factors above. That being said, here are some rules of thumb regarding which type of entity to establish:

- Size. Due to high initial and ongoing costs, a PF only makes financial sense if you plan on funding it with at least a few million dollars. For example, a $10,000 startup cost is 10% of a PF funded with $100,000, but only 1% of a PF funded with $1 million.

- Need for staff. Effective charitable giving can be a lot of work. Sometimes paid staff are needed to help set strategy, review grant requests, perform due diligence on charities, and monitor charities’ effectiveness. While a community foundation can provide some of these services for its DAF donors, a PF is necessary where dedicated staff are required.

- Investment flexibility. Some DAF sponsors allow considerable investment flexibility and permit the donor’s investment advisor to manage the DAF. But PFs provide more flexibility. Donors who want their charitable entity to invest in private real estate and private equity are likely better off using a PF.