We have met with many investment managers at our firm, and they have all been impressive. They have MBAs from elite schools, and their funds have excellent track records. They tell us about their deep expertise, how their analytical skills uncover value others don’t yet see, and that they have a portfolio management process that assembles these great ideas while controlling for risk. We like to say that if a person met with only one investment manager, they’d want to give them all their money, but if you meet with many investment managers, it’s hard to choose who to invest with because they are all impressive.

It turns out that one question does a pretty good job of predicting how an investment manager will perform: “How much of your own money do you have invested in your fund?”

The concept at the heart of this discussion is “alignment of interest.” If a strategy is deemed suitable for you, it should also be suitable for the manager. The theory is that the manager, with their own money at stake, will strive for the best outcomes while diligently managing risks. While investment managers are undoubtedly motivated by outperforming, as their compensation is often tied to their performance, is this motivation alone enough to ensure alignment of interest between investors and managers?

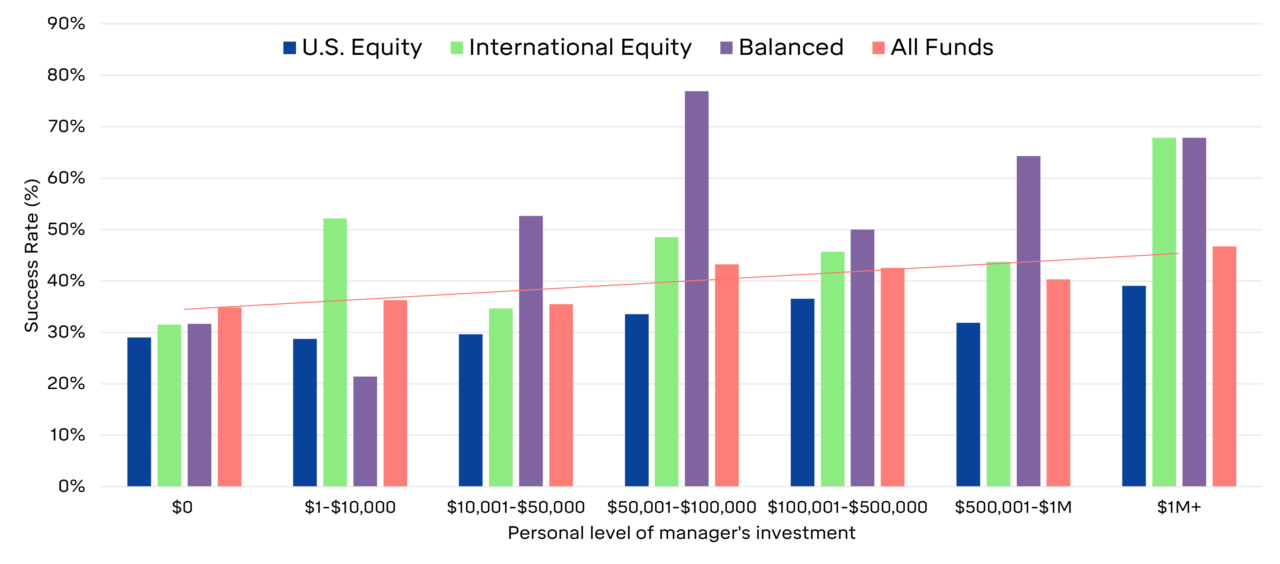

Russ Kinnell, an analyst at Morningstar, addressed this question by analyzing thousands of mutual funds. The chart below shows the results of his initial study. In it, he grouped funds by the size of the manager’s investment in its fund and then asked what percentage survived and outperformed their category peers over five years. This gave a success rate.

(In 2004, the SEC required fund managers to disclose ownership levels in their funds. The one wrinkle is that they require listing ownership in bands rather than absolute figures.)

Manager Success Rate Based on Personal Investment Levels

2009 – 2014

The results of Morningstar’s research are compelling. Managers who personally invested more of their own money in their strategies tended to see better success in outperforming. This finding was further supported by Morningstar’s subsequent research, which identified manager ownership as the second-best predictor of returns. The first predictor? Fees, a topic we’ve previously discussed. These insights can serve as practical tools for investors, helping them make informed decisions and increase their chances of success.

As an investor, there are no silver bullets in picking outperforming managers. Macro and micro factors, manager skills, and elements of luck influence outcomes. These are hard to identify and assess upfront and outside investor control. Fortunately, there are predictive tools at your disposal that carry influence. Being selective about what you pay in fees and assessing the manager’s “buy-in” are approaches you can incorporate that increase the odds of success.