The S&P 500 features leading U.S. publicly traded companies across industries, all domiciled within the U.S., and it is the proxy for the U.S. stock market as a whole. When constructing global equity portfolios, investors generally consider the S&P 500 as their primary U.S. allocation while diversifying with exposure to various international strategies. For example, if you wanted your portfolio to be 70% U.S. and 30% international, you could invest 70% of your portfolio in the S&P 500 index and 30% in an international index such as the MSCI All Country World ex-US index or MSCI EAFE index. Easy-peasy.

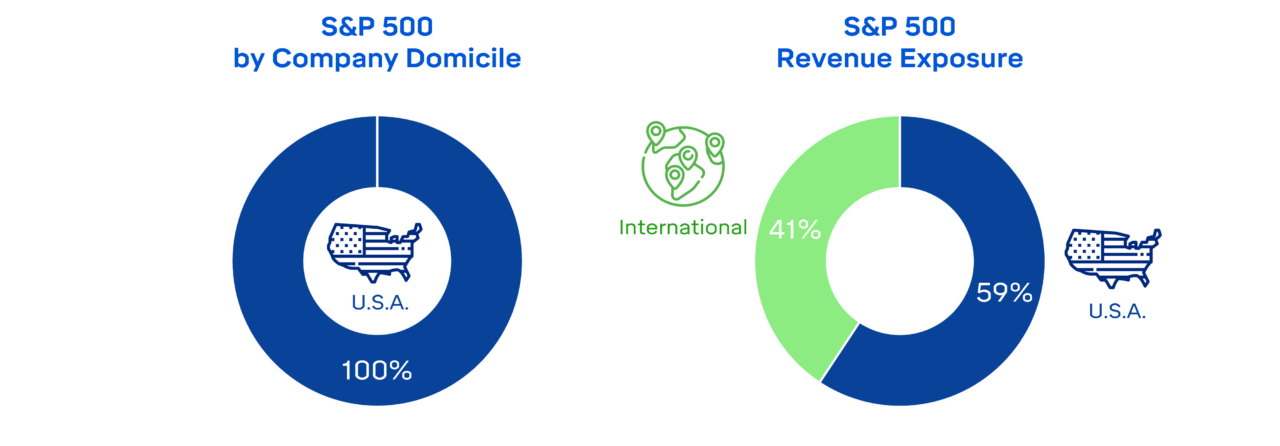

However, this approach has a wrinkle—the S&P 500 index isn’t as ‘domestic’ as one would think. Decades of globalization have interconnected the world’s economies, and most companies in the S&P 500 are multinational corporations. Although 100% of the companies in the index are domiciled in the United States, only 59% of their revenues come from it.

Could the S&P 500 Index be considered a global portfolio, then? In some sense, yes. Great. Can I finally ditch the international allocation my advisor keeps recommending? Not so fast, my friends. Let me go one step further here.

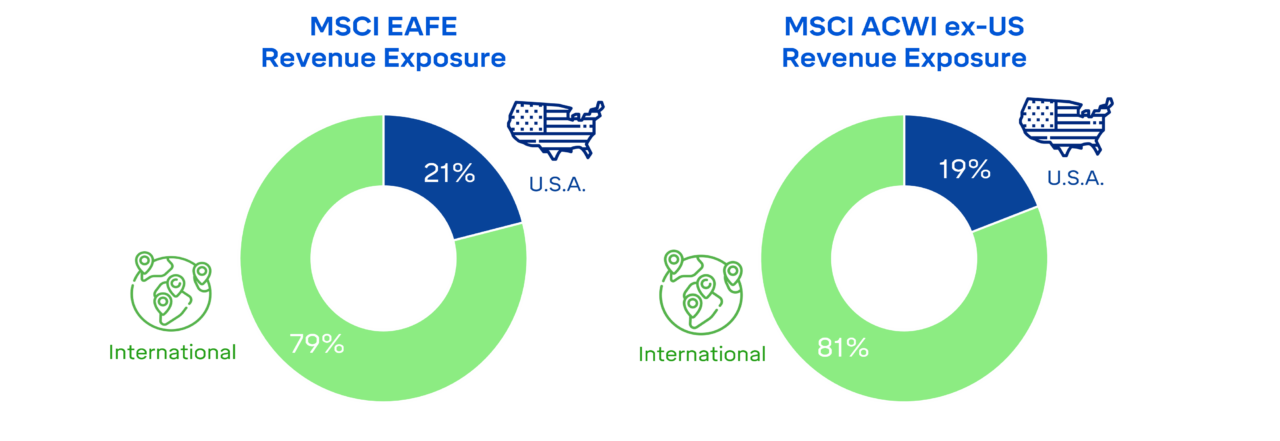

International indexes aren’t solely confined to their borders, either. Below are the revenue exposures of stocks held within two major, non-U.S. equity indexes.

Similar to the S&P 500, these indexes have both U.S. and international revenue exposure. Looking below the surface of each index, it is apparent that segmenting a company according to domicile shouldn’t be its defining characteristic.

Take Nvidia, which has the 3rd largest weighting in the S&P 500 index. It is a premier U.S.-based company that almost single-handedly supplies the insatiable thirst for artificial intelligence computing needs. Only 44% of their revenues have come from the U.S. in the past year.

Contrast that to the country Denmark’s pride and joy, Novo Nordisk. Its blockbuster weight loss drug, Ozempic, is a leader in a category estimated to be hundreds of billions of dollars. (It really is fascinating). Fifty-five percent of Novo Nordisk’s revenues come from the U.S., making it more exposed to the U.S. than Nvidia is. Because Novo is not domiciled in the U.S., it is not in the S&P 500 Index (but occupies the top spot in various international indexes).

When you compare a company’s domicile and revenue exposure, the lines get blurry. But that shouldn’t confuse investors or upend practical rules for diversifying globally. Investors don’t need to own every market or have exposure to every country. At the same time, there is no perfect allocation split between U.S. and international that has empirically held up in all environments. Great stocks are found everywhere, not just in the U.S. Having a global allocation that you can behaviorally stick with allows an investor to own the best stocks around the globe while benefiting from diversification.