The past 13 years have been a great time to be an investor. The S&P 500 has returned over 600% cumulatively from its nadir during the Financial Crisis to its closing high on January 3rd of this year.

But so far being an investor in 2022 hasn’t been any fun. The market is down about 15% from its high and flirted with bear market territory last week before a strong last two trading days (a bear market is a 20% or more decline from a high). And bonds haven’t been their usual safe haven as both taxable and muni bonds are down nearly 10% year-to-date. Ugly.

Looking ahead, investors are concerned about inflation and the Fed’s tightening monetary policy in response to inflation, the war in Ukraine and its growing economic effects, and reduced economic growth expectations both domestically and globally. It’s scary out there – what’s an investor to do?

The Costs of Being an Investor

When J. Pierpont Morgan was asked what he thought the stock market would do next, he replied, “It will fluctuate, young man. It will fluctuate.” Words to live by, for sure, as the market does indeed fluctuate.

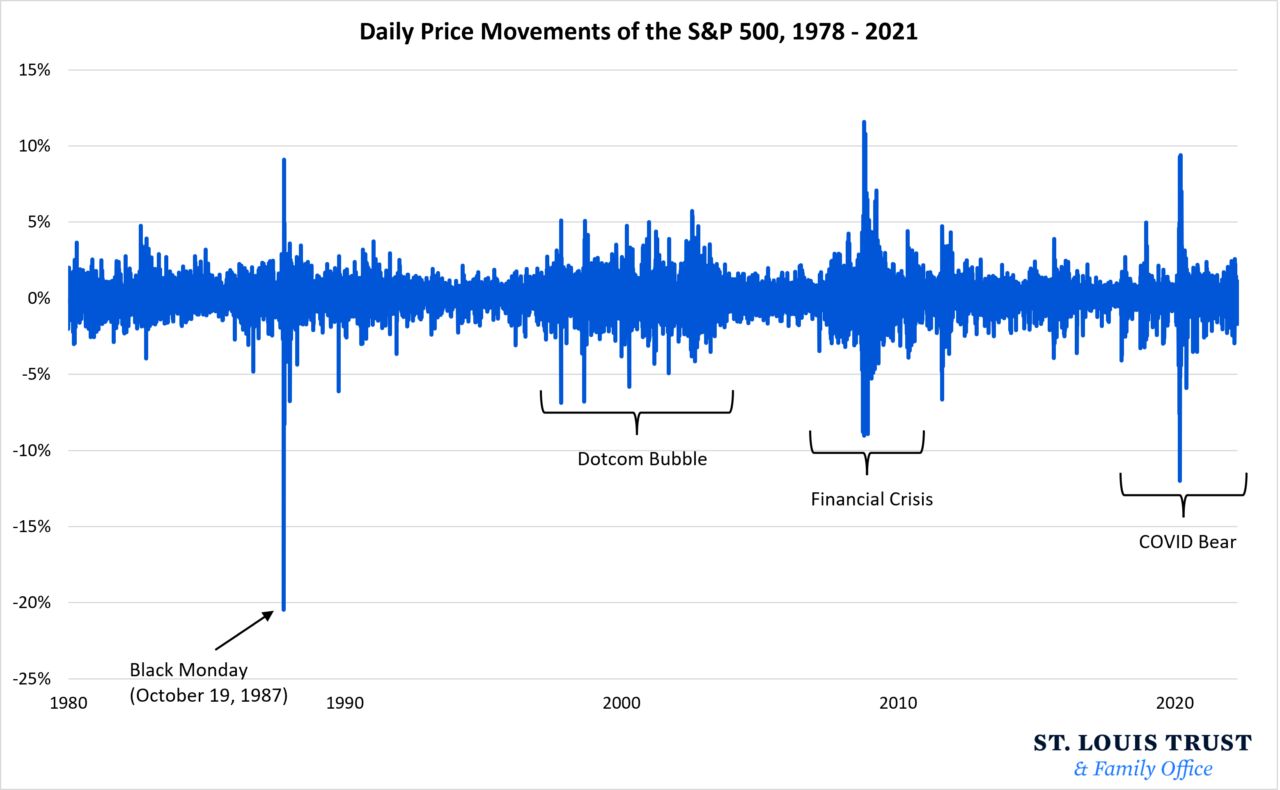

Yet Morgan’s statement fails to fully capture the reality of the market. Days, months, and even years go by with the market bouncing around within an expected range – small fluctuations. But every so often, volatility spikes as huge price swings occur with little or no warning. The figure below depicts the daily price movements of the S&P 500 since 1978. You can see how the market moves close to the average for years and then, unexpectedly, goes crazy.

Unpredictable swings, volatility spikes, declines, and bear markets are the costs of being an investor. You can’t reap the benefits of investing (like the 600%+ over the past 13 years) without paying those costs. For years investors have worried that the strong returns and high valuations in the stock market aren’t sustainable and that a bear market must be looming. Maybe the stock market is headed for bear territory. Or maybe it isn’t. There’s no way to know.

What We Do Know

While we don’t know what the market will do in the future, here is a reminder of three important things we do know which can help shape your actions through market volatility and declines:

1. Market timing doesn’t work. Loads of academic studies confirm that it’s impossible to consistently profit from timing the market. Sometimes you’ll get lucky; more often you won’t. This, of course, makes perfect sense. If certain things consistently signaled market tops and bottoms, everyone would know them; buyers and sellers would use the information to set their prices accordingly. And there ends the utility of those signals.

Another major problem with timing the stock market is that you must be right twice to be successful once. Just getting out near the top isn’t enough. You also need to get back in near the bottom which is incredibly hard because market bottoms occur when economic news is still horrible and the market seems to be in free-fall.

2. “Coast is clear” investing isn’t effective. Markets move in cycles. Boom followed by bust followed by boom. Cycles vary in both duration as well as the magnitude of their peaks and valleys; there are no permanent plateaus. There’s a paradoxical point embedded in market cycles: the most significant risk in investing occurs when everything seems to be going well. In contrast, the panic found deep in a bear market or recession often provides the best investment opportunities. Thus, waiting until the coast is clear, when everything seems relatively safe and the economy is healthy, is not a profitable strategy.

As investors, it’s essential not to capitulate to the fear that comes with the panicky part of the cycle or indulge in the greed that accompanies the euphoria. Instead, view market turmoil and fear as signals of investment opportunity.

3. The stock market is not the economy. Yesterday (May 15, 2022), Lloyd Blankfein, Senior Chairman of Goldman Sachs, warned that recession risk is “very high.” Hearing that warning may cause investors to want to move to cash to weather the coming storm. Even if Goldman is correct (which is questionable given that their outlook for 2022 was for strong economic growth with “the first half to be stronger, benefitting from improving virus conditions, economic re-opening, pent-up consumption, and inventory rebuilding”) that doesn’t mean that selling stocks is the right move because economic growth and stock market returns aren’t correlated. This lack of correlation is because investor decision-making tends to anticipate the economy’s changed circumstances; stock market fluctuations predict changes in GDP, but movements in GDP do not predict stock market returns. Over time, forward-looking predictions of economic changes are incorporated in today’s fluctuations in the stock market. We saw this in the Spring of 2020 during the COVID bear market and the Spring of 2009 during the Financial Crisis: the market bottomed and rebounded even though the economic news was horrible.

So, when economic news is dire, know that the market has already absorbed it and priced it in. Surprises move markets, not expected news, because market prices reflect the range of expected news.

What Should Investors Do?

History has shown that when markets are volatile, the best course of action is almost always to ignore both the markets and our portfolios. If you’re tempted to change your investments because of bad things you hear/read in the media, first ask yourself these questions:

- Do you know something the market doesn’t?

- Or, are you weighting widely known news differently than everyone else?

- If so, do you have a good reason?

If the answers to these questions are no, then it’s probably best to resist the urge to make portfolio changes. As Vanguard founder John Bogle said, “the best rule you can possibly follow is not ‘Don’t stand there, do something,’ but ‘Don’t do something, stand there!’”

Inactivity, except when your investment allocation calls for rebalancing (which likely isn’t the case given bonds have declined along with stocks), is the best course of action in the face of both fear and greed. Remind yourself that volatility, market declines, and bear markets are the costs of being an investor and ride it out.