Even though cannabis use has been legalized in 41 states (recreational use in 24 states and medical use in another 17), it is still classified as an illegal “Schedule I” narcotic under federal law, which is the same as drugs like heroin and LSD. Cannabis’s illegal federal status has hampered the industry’s profitability, access to the capital markets and banking, and growth.

But this week, news leaked that the Drug Enforcement Agency (DEA) may reclassify cannabis down to a Schedule III narcotic. While Schedule III drugs are still illegal under federal law, being classified at that lower level will have a significant impact on the cannabis industry. Let’s dig into a few of them.

Relief From Tax Code Section 280E

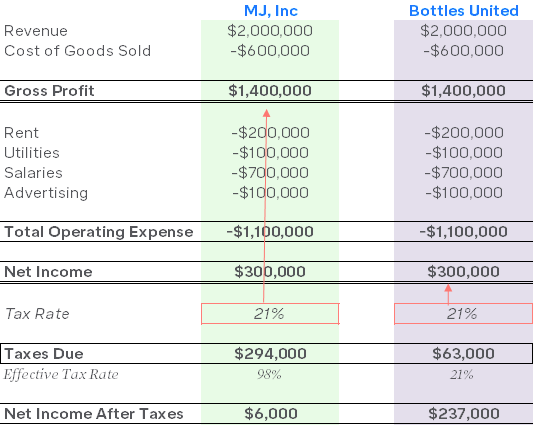

Corporations are taxed on their income after deducting their ordinary and necessary business expenses unless they are involved in the trafficking of controlled (i.e., Schedule I) substances like cannabis, in which case they pay taxes based on gross income without the benefit of deducting their expenses. As you might imagine, this dramatically increases the tax burden of cannabis companies.

Here is a simple example comparing two companies, MJ, Inc., a cannabis company, and Bottles United, a non-cannabis company:

MJ Inc. and Bottles United make the same income before taxes, but the cannabis company pays $294k in taxes, while the non-cannabis company pays $63k.

Rescheduling from a Schedule I to a Schedule III narcotic would remove the tax burden of 280E on cannabis businesses, which will make them more appealing to investors from a cash flow and profitability perspective.

Open the Door for Institutional Capital and Banking

An impediment to cannabis industry growth has been the access to institutional capital and the banking system.

Institutional investors understandably have been wary about investing in companies that sell Schedule I drugs. Plus, the major stock exchanges haven’t allowed publicly traded cannabis companies to list on their exchanges. Today, most cannabis companies are listed on the Toronto Stock Exchange, the 10th largest stock exchange, limiting their visibility to Wall Street Analysts and institutional capital.

An even bigger issue has been that federally chartered banks haven’t wanted to bank cannabis companies, forcing them to operate in cash or through less secure banking alternatives.

A rescheduling wouldn’t eliminate these obstacles but may make it more palatable for Congress to pass laws that decriminalize cannabis production, distribution, and possession. Once cannabis is no longer considered federally illegal, publicly traded cannabis companies would be able to “up-list” to one of the major stock exchanges, which would open the door to larger and more sophisticated investors. This also accomplishes what the SAFE (or now SAFER) Banking Act intended: allowing cannabis businesses to access essential banking services.

Advice

Rescheduling solves some of the biggest problems the cannabis industry has been facing, but it does not weed out every risk. Improving cash flows, banking access, and stock exchange listings are critical pieces of the puzzle. However, inherent risks in this sector still exist, and a rescheduling recommendation does not solve all of these problems.

This isn’t a green light signaling investors to GO, but it may be a yellow light advising them to slow down and pay closer attention.