How big of a threat do higher interest rates pose to consumers and businesses?

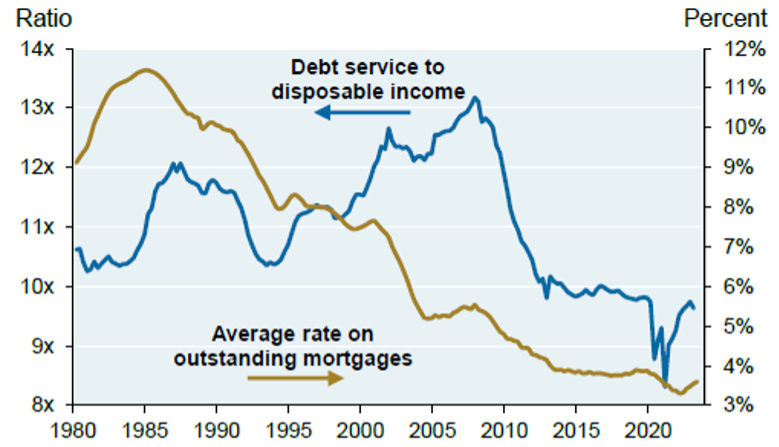

First, Consumers. U.S. household debt service costs remain low and the U.S. consumer seems to be in good shape. Recent data indicates that 98% of mortgage borrowers have benefited from locking in rates below the current market. It’s estimated that the average coupon on outstanding residential mortgages is approximately 3.5% compared to a market rate of 7.5% today, as depicted in the below chart.

US Household Debt

Outside the temporary pandemic stimulus surge, consumers are in the best financial position to service their debt in the past 40 years. An encouraging sign given consumer spending makes up 60% – 70% of GDP.

How are companies doing? Will the S&P 500 companies see profits erode once higher borrowing costs hit? Probably, but that could take time.

Companies have made a lot of changes in recent years to blunt the impact of higher borrowing costs, mainly by refinancing debt in 2020 and 2021 and extending the maturities (a notable example: Apple sold 5-year bonds in 2021 that had yields of 0.7% and a 40-year bond at 2.8%! Gee, where do I get my hands on these gems…).

The below chart from Bank of America shows the effective interest rate that S&P 500 companies are paying on their debt. It’s low both in absolute terms and historical standards.

S&P 500 Effective Interest Rates Over Time

Based on this data, the US consumer and S&P 500 companies have taken advantage of the low-rate environment and are on solid footing. Over time, however, as refinancing and new borrowing needs manifest, the trend will eventually pivot and start to weigh more on the ability of consumers to spend and companies to generate profits. There won’t be one day when the market sniffs this out and declares, “time to drop 5% on the threat of higher interest rates!” (although you will likely see versions of this headline repeatedly in the financial news, as they look to distill the complex, adaptive nature of the markets into one root cause to engage readership).

Let us live in this moment, where higher interest rates don’t scare us and the resilient economy is fueled by Taylor Swift, Beyoncé, and pumpkin spice.