Inflation remains a hot topic and continues to manifest itself across many consumer goods and services. However, one cost has been on a deflationary trajectory for decades and shows no signs of stopping: investment product fees—particularly the costs paid to invest in baskets of stocks and bonds. Could this fee compression trend get to the point where these products are free? Or dare I say, better than free? (They pay us!!)

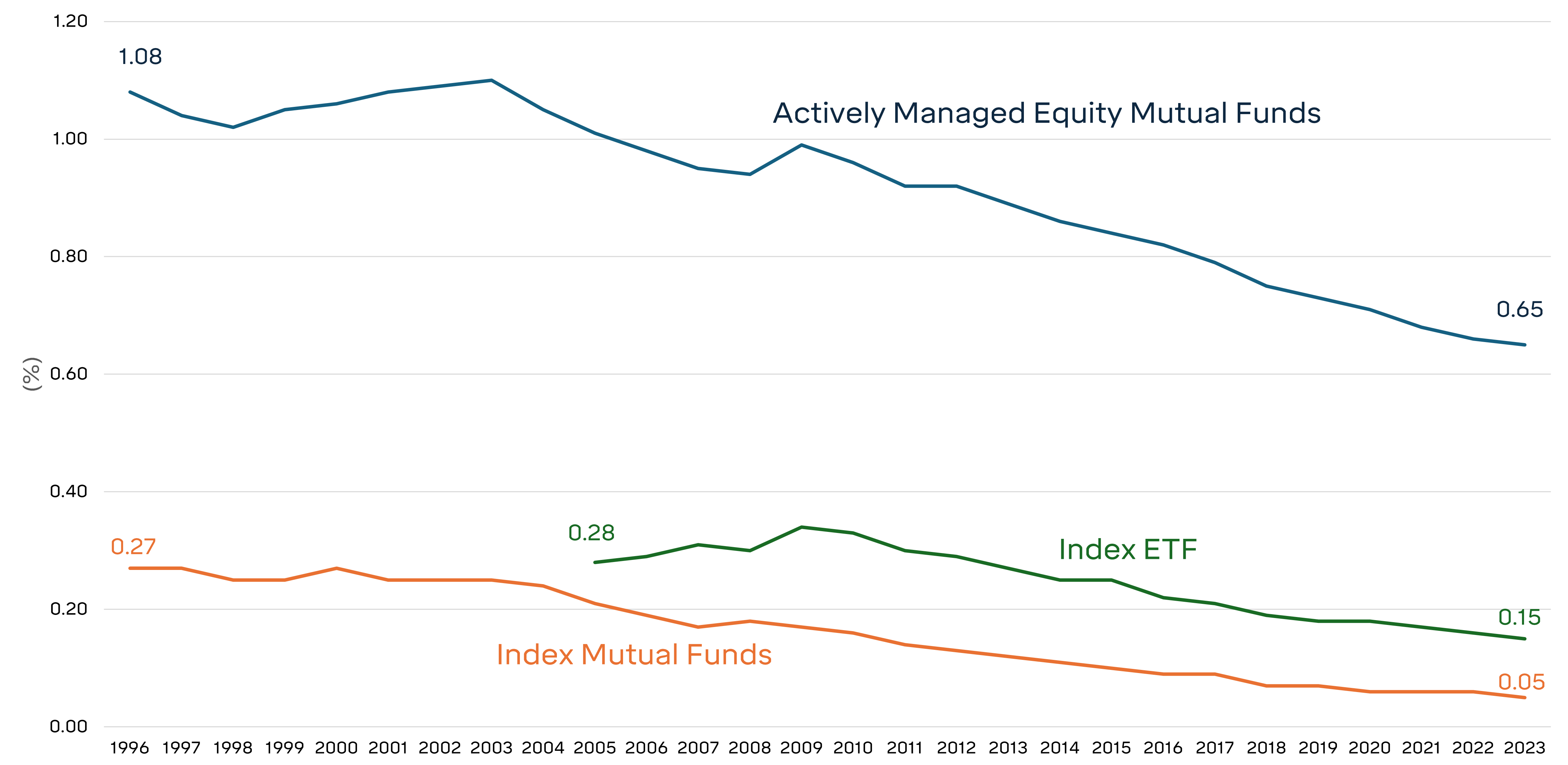

The chart below shows the expense ratio trends of stock funds divided into distinct groupings: (1) active mutual funds – those strategies that seek to use manager skill in efforts to outperform their benchmark and (2) index mutual funds and ETFs – strategies that are designed to track a reference stock index and require little to no management oversight. One thing that is clear in all categories is that the expenses have fallen over time. And index funds are inching closer to zero.

Average Expense Ratios

It’s worth looking back and seeing how we got here. Historically, buying and selling stocks or funds cost a lot. The privilege of using a stockbroker or investing in a mutual fund manager came with a hefty price tag. Broker commissions (sometimes in the hundreds of dollars!), marketing fees, and sales charges added up several percentage points of an investor’s cost.

Fortunately, several powerful factors emerged over the last several decades that reduced these investment product fees:

- Increased competition among asset managers and their need to attract more investors.

- Economies of scale – asset managers got bigger and could afford to charge less for products while still earning a profit.

- The track record of active management beating the market worsened. The market now outperforms the vast majority of active managers. And it’s now easy to invest in low-cost index funds as an alternative to active managers.

- Technology advancements have lowered the cost of managing and distributing products.

- Regulatory changes – greater fee transparency was enforced, and sure enough, the marketplace adapted.

The most recent benefit for investors is that trading stocks, and in some cases funds/ETFs, is now (mostly) free. In case you have that one friend on Robinhood churning their portfolio over three times a week, just know that it doesn’t cost anything to buy and sell. Yay?

Will the product fees fall to zero or even below? What seemed like an absurd question to ask years ago isn’t that far off today. There are currently free index funds and ETFs. A few years ago, an issuer even came out with an index ETF that issued rebates to its investors that took the expense ratio to a negative -0.05%. Absurdity! (Note: it didn’t last.)

How do these product issuers make any money? Fear not, capitalists! Funds that package stocks together can earn money by lending those stocks to other investors at a cost (there is a huge market for this service). This allows them to subsidize the cost for you.

All this begs the question – is this a fad or a trend? I’d argue that fee compression forces continue to persist in the marketplace, and the free genie won’t be put back in the box. Our investment philosophy has always centered around controlling fees, and research has shown that lower fees increase the likelihood of outperformance. In an environment where life’s costs continue to rise, it’s nice to know investors may continue to retain more value for their dollar.